Roth IRA Conversion Tips

The Roth IRA conversion rules are changing in 2010, here are a few things to consider if you’ve been thinking about converting your traditional IRA to a Roth IRA.

Roth IRA Conversion Limits

The current IRS rules only allow you to convert your traditional IRA to a Roth IRA if your modified adjusted gross income is $100,000 or under. Next year that income limitation will be removed so you can convert to a Roth IRA regardless of your income in 2010.

IRA Conversion Taxes

Converting from a traditional IRA to a Roth doesn’t allow you to skip out on the taxes you owe. You still have to pay income tax on the amount you convert into your Roth IRA.

However, if you convert your traditional IRA in 2010 you can delay reporting of the income over a two year schedule. The rules allow you to defer 50% of the income to 2011 and the other 50% until 2012.

If you don’t have the money to pay the taxes you’ll owe, it’s probably not worth it to convert your traditional IRA to a Roth IRA until you have the funds. If you pay the taxes with funds from your IRA you’ll be missing out on the tax-free growth of the funds you withdraw. In addition if you’re under 59 1/2 you’ll proably also have to pay a penalty.

Retirement Tax Brackets

If you think your tax bracket will be lower in retirement than it is now then the taxes you would pay when converting to a Roth IRA next year could be higher than what you would pay when widthdrawing from a traditional IRA if you decided not to convert it.

Of course no one knows for sure what their income will be in retirement so this decision has to be made based on assumptions about your financial situation in the future.

Tips to Improve Your Credit Score

Improving your credit score isn’t something that happens overnight but by following the suggestions below you should be able to raise your credit score over time.

Don’t Pay Your Bills Late

Your payment history is the most heavily weighted factor that goes into your credit score so make sure you’re at least making your minimum payments. If those are more than you can afford sometimes the companies you owe money to are willing to put you on an extended payment plan.

Maintain Low Credit Card Balances

The next most important factor making up your credit score is the percentage of your available credit that you borrow. If you’re constantly using up over 30% or 40% of your credit available you will be deemed a higher risk.

Build Credit History

The average age of your credit accounts is the next biggest component of your credit score. If you add a bunch of new credit and cancel old cards this will drag down the average age of your credit accounts and your credit score along with it.

Use a Mix of Debt

This matters because companies look at the different types of debt that you have and weigh some more heavily than others. For example, your credit card debt carries more weight than your mortgage or car loan.

Reduce New Credit Lines

Credit reporting agencies Experian, Equifax, and TransUnion monitor for attempts to open new lines of credit. Each time a lender does a hard pull on your credit report that credit inquiry is noted and the more you have the worse an effect it can have on your credit score.

Starting a Business & Being Smart With Your Money

Starting a successful business is not an easy task. There’s a lot of time and/or money that goes into getting your idea organized and off the ground. As people get farther into implementing their business they usually realize that they’ll need more money to make their idea a reality.

Last night I saw a show for the first time called Shark Tank where entrepreneurs pitch thier ideas to a group of wealthy investors, the “Sharks”, and ask for a specific amount of money in return for a stake in their company. I think they’ve been on the air funding entrepreneurs for a while, but I don’t watch that much TV so this was the first time I heard about it.

Critical Investors

I watched as several budding business owners made the case for their product and why it would be a good investment for the “Sharks”. One lady had spent 3 years and her entire life savings developing her company only to have every investor deny her any money.

Each of the “Sharks” had legitimate concerns about the feasibility of implementing her idea and competing against the businesses already existing in the industry. One guy came out and told her that her idea was dead and she obviously took it very hard. After the lady left, the panel of investors discussed whether he was too hard on her, whether he should have gone about telling her the same thing in a more constructive way.

The guy replied with something along the lines of, she needs to know that her business isn’t going to succeed before she plows any more time and money into it so she can move onto something else.

Protecting Your Money

Think how much easier that situation would have been for the women if she would have had that conversation with a group of knowledgeable business people three years ago. Before putting her life savings and years of work into the product. Now she’s totally committed to making the idea work, she can’t entertain other alternatives, she’s backed into a corner.

I think it would be a good use of any entrepreneur’s money to get a panel of experienced people to look at their idea and give them feedback when they’re first getting started. The goal wouldn’t be to get a yes/no answer, yes you should pursue it or no you shouldn’t. Instead the goal would be to build a list of questions that needed to be answered

To compile a set of objections that shoud be addressed early on to determine the feasibility of success and the potential return on investment. Every entrepreneur will hear negative feedback about their idea and can’t let the negativity alone stop them from pursuing their dream. However they can make note of the issues people raise and research them early on to help prevent themselves from throwing everything they have down a money pit.

Business Research Example

I’ve enjoyed the following set of articles from Perry Marshall. He tells a story of his role on a board of directors where he raises legitimate objections about the economic feasibility of a major business deal and the pushback he gets from the leader of the business.

Saving Money on a Printer

I wrote not too long ago how we saved a ton by buying overstock and returned items and we found another deal this week! My wife needed a new printer but instead of heading to Best Buy I stopped by another local discount store hoping to save some money.

I had come on the right day, they had a pallet of HP Deskjet printers on sale for half of the retail price. They were discounted because the boxes had been damaged. Not damaged as in ripped open or totally demolished but pretty minor dents or scratches in the box.

They assured me I could return the printer if it didn’t work for store credit as long as I kept my reiciept so I had nothing to lose. I got it home, hooked it up, and it works like a charm. I sure am glad I stopped by the discount store, saved myself $70! I guess the moral is that it pays to shop around.

Here are some of the money articles I enjoyed this week:

Energy Costs

Save on Heating & Cooling Costs @ Free Money Finance

How to Make Your Home More Energy Efficient @ My Dollar Plan

Career

Brush Up on Your Job Skills @ Generation X Finance

Your Take: Your First Job? @ Bargaineering

Investing

Target Date Mutual Funds Getting Cheaper @ Five Cent Nickel

When Your Investment Portfolio Returns To New Highs @ The Digerati Life

Automobiles

Reduce Your Auto Insurance @ Mighty Bargain Hunter

Four Years Without a Car Payment @ No Credit Needed

Other

Taking Baby Steps Towards Financial Goals @ Million Dollar Journey

One Million Visitors @ Lazy Man & Money

Financial Impact of Moving @ Suns Financial Diary

Avoid Being Caught By Scammers @ Get Rich Slowly

Is Getting a Large Tax Refund Bad? @ Frugal Dad

Reflections on 9/11 @ Brip Blap

Small Business Administration’s Top 10 Tips @ Consumerism Commentary

Thanks to the hosts of the following Carnivals:

- Automatic Finances – Money Hacks

- Home School Bytes – Homeschooling

- Modern Tightwad – Money Hacks

- Budgets are Sexy – Personal Finance

Have a great weekend!

Using Licensed Contractors for Home Improvement Projects

The benefits of using licensed contractors was the main feature of Angies List magazine this month. When we finished out our basement a few years ago price was the primary factor for which contractors we chose. We narrowed it down to several contractors that had been recommended and picked the one with the lowest price, with no regard to which were licensed.

Contractor Pricing and Licenses

Looking back on our approach of going with the lowest price, it may be that the contractors we hired weren’t licensed. The Angies List article looked at the variety of license fees required across cities and states and gave an example of one company in Cincinnati that pays around $30,000 a year to meet the requirements.

When companies spend that much on fees they often pass part of it on to their customers. However, if a company isn’t licensed then they won’t pay the fees and can afford to offer the work for a lower price. The article suggested that you ask for proof of a license prior to hiring a contractor, the ones they spoke with said that customers rarely to see their license.

Liability Insurance

One of the main reasons the article recommends checking for a license is that typically in order to get a license a contractor will have to show proof of insurance. Their liability insurance should cover property damage and bodily injury caused by work. However if they don’t have insurance and they get injured you could potentially have to pay for it if your homeowner’s insurance doesn’t cover it all.

Quality of Work

Of course the other reason to find a licensed contractor is that it’s supposed to indicate they’ve been through the proper training and testing and know what they’re doing. Based on the range of local rules and enforcement policies it sounds as though the competence reflected by the license may vary depending on where you live.

Summer Spending Trends

Do you tend to spend more money in the summer or less? We spend more time doing outside activities that cost nothing, like going to the park or going for a walk. But typically we do tend to do more travelling in the summer which can add up pretty quick.

Quicken Online looked at how people reported spending their money from June to August of this year. The spending analysis seemed to show that people around the US spent frugally this summer:

Less Travel: On average, consumers spent a modest $300 on vacation related expenses this summer

Less Eating Out: Consumers spent an average of $543 on meals at restaurants versus $887 on groceries

Still Using Credit: Americans charged an average of $2692 on their credit cards while only spending $1,447 in cash.

How about you, did you spend more or less this summer?

Costs of Raising Children – Kid Expenses Continued

Yesterday I wrote about the costs of raising children and got a few emails reminding me of some of the costs that I left off the list. I don’t know how I missed some of these like childcare and insurance since they’re pretty big chunks of money. I guess there are so many expenses it’s easy to overlook a few and I’m sure I still won’t have captured them all. Here are some more costs of raising kids.

Childcare

Childcare can be really expensive. It depends on a variety of things such as the age of your kid(s), how many children you have, how many days you need childcare, how many providers are watching over your kids, the activities they do, etc.

We are happy using an in home daycare that is cheaper than the chains like Kinder Care / La Petite and is very flexible with scheduling but the fees still add up pretty quickly. I have co-workers with 2 kids that have day care expenses of several hundred dollars a week.

Laundry

Kids are always getting their clothes, blankets, and sheets dirty. Whether it’s dirt, food, or bodily fluids children can’t seem to go a few hours without getting something on their clothes. Of course, if it’s a little dirt or a food smudge you can let it go but if they’re covered in mud or dripping in urine then you have little choice other than soaking the clothes in the sink and putting on another outfit. Before you know it the laundry basket is full, their drawer is empty, and it’s time for another load of wash.

Insurance

I talked about medical bills and co-pays last time but I forgot to mention insurance premiums. Each time we have a kid it costs us more in monthly insurance premiums to add them to our coverage.

Of course you can lower your premiums by raising your deductibles but that’s quite a balancing act of guessing how sick or hurt your kids will get in the year ahead and picking your deductibles.

Activities

We enrolled our son in soccer lessons for the first time this year. It was also our first time paying “activity fees” for our kids. It was $80 for 8 sessions so it wasn’t outrageous but it was $80 that we weren’t spending a year ago. As kids get older and get into more activities the budget for stuff like this will have to increase. I have co-workers whose kids are involved in multiple sports and different activies that are always moaning about all the fees.

One of the activities we like to do that isn’t expensive is take a picnic to the park. Another one our son loves that is free is taking an afternoon trip to the public library.

Babysitters

For a good night away from the kids you’re going to need at least 3–4 hours to grab dinner and see a movie or some other fun event. The more kids you have and the longer you’re away, the more you have to pay the babysitter. You also have to make sure there’s food for the babysitter to eat for dinner. So on top of the money you spend on dinner and a movie you’re also shelling out cash for someone to watch your kids.

As I mentioned yesterday, the joys of parenthood are certainly worth the added expenses but they can add up quickly so make sure to budget for them.

Costs of Raising Children

Being a parent can be a lot of fun but it can also be quite expensive. If you’re thinking about having children, make sure you budget in enough cash each month for all the different ways kids can cost you money.

Health Care

Medicine

It seems kids, at least young ones, are always getting sick. I’m sure part of it is that they’re often running around other little kids with runny noses and stomach bugs. It doesn’t help that they like to put everything in their mouth, never want to wash their hands, don’t cover their mouth when they cough, and are too small to understand the concept of germs.

For example, when our son was younger he kept getting some kind of eye goop from the kids at daycare where his eyes would crust shut. The doctor gave us a prescription for a tiny little bottle of drops that cost us $50. At $50 a pop, I would dread every time I saw the goop start to accumulate in his eyes.

Then, I’d catch it from him and have watery, crusty eyes as well but the doctor said not to share the bottle of drops. They wanted me to go to my doctor and get a prescription and get my own bottle. Dreading another co-pay and spending another $50 on a teeny tiny bottle I didn’t listen and borrowed his drops. Luckily my goop went away.

Co-pays

Of course, anytime your kid gets a cold you have to worry if they’re going to get an ear infection. You don’t really know if they have one or not but if they’re acting fussy and crying a lot you start to wonder if the cold caused an ear infection. So you take them in to see the pediatrician which means you have a co-pay.

Sometimes they have the ear infection, sometimes they don’t; but you pay for the doctor’s visit no matter what. The thing is, you love your kid and don’t want them to be in pain. So whether it’s a suspected ear infection or some other ailment, when something seems wrong with your kid you worry about them and call up the pediatrician. All those doctor’s visits add up over time.

Time Off

When your son or daughter is sick, someone has to stay home with them and that means taking a sick day or vacation day. If you’ve worked at a job for many years you may have a surplus of days accumulated, but if not then each one of those days is pretty valuable.

It’s not just sick kids that will eat up your vacation days. For example, last week our daughter got kicked out of daycare because she wouldn’t take a bottle from the babysitter. My wife went to pick her up and our baby sitter said she couldn’t come back the next day since she was refusing to eat from a bottle. With little notice to find an alternate, I ended up having to take a day of vacation to stay home with her.

Destruction

Usually kids don’t mean to be destructive but due to their youth and ignorance they destroy things unknowingly or accidentally. For example, maybe they’ll pick up something fragile (cell phone, camera, decoration, etc) and drop it as they walk across the floor.

Or they’ll be potty training and have an accident and get pee stains all over the furniture or the carpet.

Maybe they’ll be washing their hands and plug up the sink and overflow water all over the bathroom.

They can also be destructive towards their own bodies. A big cut or a big fall can lead to a an expensive and day-consuming trip to the emergency room.

I’m sure the list is endless, there are many different ways kids can destroy things.

Babies

Babies cause so many expenses that they’re in a whole cost category of their own. Cribs, strollers, diapers, and formula aren’t cheap. Then there’s the process of being pregnant and actually delivering the baby. Doctor visits and hospital stays keep the medical bills flowing in for a while. Depending on the mother, you might also drop a bunch of money getting the baby room ready, which can mean new furniture and decorating.

Toys / Clothes

You can certainly save money on toys and clothes by buying them at garage sales or discount stores but those costs still add up. Your kids will either destroy or grow out of the clothes and toys that you buy them so every season you’re spending more money.

Cost of Kids

So far, we’ve only experienced the costs of the first few years of life. We haven’t gotten to expenses for school age kids, let alone the costs of college. I don’t know what the total bill will be but I know it’s going to be MASSIVE.

However, the joy of being a parent and seeing your kids learn and grow is worth more than the large financial cost of raising children. Although they may deplete your bank account, they’ll fill up your heart and make you happy in ways you didn’t know were possible. Just make sure you budget for the little money sucking bundles of joy.

Lending Club Promotion – $2500 Peer Lending Giveaway

Lending Club has provided an alternative to bank financing with their peer to peer loan marketplace since 2007. During that time they’ve continually been improving the process of lending and borrowing money with a peer to peer model and now they’re closing in on 25K investors.

Lending Club is giving away $2,500 cash to the person that becomes their 25,000th investor; based on their growth rates they anticipate that person will join sometime in the month of September.

Lending Club Giveaway Rules

If you’re interested in going after the $2,500 prize, the only requirements are that you must be 18 or older and a legal resident of the US. You have to open an account before the end of the month and link it to a verified bank account. If you’re the 25,000th investor Lending Club will notify you by e-mail within 5 business days of the end of the month.

Lending Club Performance

I included a Lending Club review a while back about how you can borrow money with the peer lending model.

It seems as though Lending Club has plenty of people looking for loans and in order to meet the demand they’d like to encourage more people to become investors.

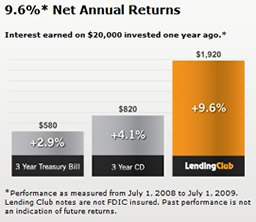

They’ve been closely tracking the performance of peer loans and from July of last year to July of this year the average net annualized returns have been 9.6%.

Of course you don’t have to fund part of a loan in order to be eligible for the prize; which is a good thing because I don’t think people would want to invest any money without taking the time to learn the ins and out of the peer lending process. Lending Club does have good tutorials and guides to help you understand the process and tools to help you search and evaulate loans.

If you’re interested in becoming a lender or entering the $2,500 cash giveaway you can enter by registering with Lending Club – Click Here.

Four New Retirement Saving & Planning Tools?

Retirement planning can be daunting. You make a lot of assumptions about where you’ll be financially decades down the road. You assume that the tax laws won’t do anything crazy and that the financial markets will continue to operate as they have for decades. You also debate whether Social Security funds are going to shrivel up and blow away by the time you’re ready for them.

Although retirement planning is not simple it’s still very necessary to help give you some financial security in your later years. The Obama administration made some proposals in their weekly address that are intended to help with retirement savings and education. Here they are:

1) Allow employees of small businesses to automatically enroll in a 401(k) or an individual retirement account.

2) Offer the option to receive your federal tax refund as a savings bond.

3) Enable employees to put payments for unused vacation and sick days into their retirement plan if they wish.

4) Retirement Planning Education. The IRS and the Treasury Department are working on a simplified guide and website to help translate the financial rules into a format that’s easier to understand.

I think finding ways to allow small businesses to let their employees automatically put money into a retirement account is a good idea. The savings bond for your tax refund sounds good, I wonder how many people will actually do it? I would love to put my unused sick days towards my retirement plan but I wonder how much that will cost companies and what impact that will have on them. I don’t think financial education is a bad idea but I wonder how many people will make use of the site and how much it will cost to build and promote it.

What are your thoughts on the retirement savings and education proposals?