The Best Cash Back Debit Cards

Cash back debit cards could be a good fit for you if you’d like to earn rewards on your purchases but aren’t a fan of cash back credit cards. While earning rewards on a credit card is nice, if you carry a balance the interest charges will easily exceed any cash or points you earn.

If you make sure you pay off your balance each month this isn’t an issue but if you’d like to earn cash back without having to ever worry about paying interest, then a cash back debit card could be a good choice. There are several debit cards that reward you on your every day spending just like the cash back credit cards. Your rewards are usually based on your spending, but some cards will boost rewards for certain categories.

Let’s take a look at some of the cash back debit cards that are available nationally. You may be able to find better deals with a local or regional bank, but here’s what some of the big names are offering.

Chase RealCash

- The Reward: With Chase you can get 3% at select categories of retailers such as grocery stores, gas stations, drug stores, and more.

- The Fine Print: The card is capped at $500 rewards per year (you’d have to spend $16,000 to reach it). The real kicker is there is a $25 annual fee, just like a debit card. Chase will give you a $10 cash back bonus when you first use the card, but you still start out $15 in the hole to the bank. You’ll have to spend $500 just to earn enough cash back to get out of that hole. Purchases must be non-PIN transactions.

Bank of America Add It Up

- The Reward: You can earn up to 20% cash back at certain retailers.

- The Fine Print: You only earn cash back at those retailers. You have to log in to the Bank of America “Add It Up” website before visiting the retailer’s website to receive the cash back. You must earn $5 in cash back before you can receive your rewards.

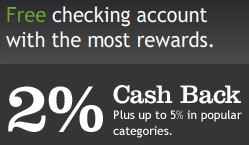

PerkStreet Financial

- The Reward: Earn 2% rewards on non-PIN purchases if your account balance is over $5,000 on the day of the purchases. Rewards can be redeemed for “cups of coffee”, downloaded songs, or cash/gift cards. Rewards can jump to 5% at select retailers.

- The Fine Print: If your account balance starts at less than $5,000 on the day you swipe your card then you only earn 1% rewards. For a more in-depth look see my PerkStreet review.

US Bank

- The Reward: Earn up to 25% cash back at select retailers. Earn 0.5% for non-PIN purchases at other retailers.

- The Fine Print: The really good cash back is limited to whomever US Bank partners with. Otherwise 0.5% isn’t a lot. You must earn $5 to redeem cash back. At 0.5% that would mean spending $1,000 to get $5.

The Best Cash Back Debit Card

The best card is whichever fits your needs the best. If you happened to spend a lot at the retailers Bank of America partners with then that might be the best fit (if you only used the card at those retailers).

For an all-purpose account Chase has higher cash back, but you start out in the hole due to the annual fee and the higher rewards only occur for certain categories. Since PerkStreet offers cashback regardless of where the purchase is made they probably win out for overall best cash back debit card.

Credit Card Offers & Promotions

Credit card offers seem to have been piling up in my inbox after listing some of the credit card promotions last week. Discover, Chase, and Citi all have cash back or cash bonuses that I didn’t include so I’ll cover them here. I’ll start with the card offer ending the soonest, additional cash back from Chase.

Cash Back

For a limited time, the Chase Freedom card is paying 8% cash back when used for online purchases at the Apple Online Store, Gap, Toys “R” Us, Barnes & Noble, Dick’s Sporting Goods, Sears, and Macy’s.

Discover is one-upping Chase with almost half of their online retail partners raising their cash back an additional 5% when you use the Discover card online through their shopping portal. I’ll put a list of some of the top merchants and their cash back percentages at the end of the post.

Cash Bonuses

Cash Back Merchants

There are too many online merchants to list that have doubled cash back through Discover’s shopping portal but I categorized some of the most popular and listed them below so you can see if any are a place that you’d shop. I’ve also shown the cash back percentage they’re offering on purchases.

Department Stores

- Kohls – 10%

- Macys – 10%

- Sears – 10%

- Bloomingdale’s – 10%

Apparel

- Gap – 10%

- Old Navy – 10%

- Banana Republic – 10%

- The Limited – 10%

- Lands End – 10%

- DSW – 10%

Sporting Goods

- Nike – 15%

- Finish Line – 15%

- Sierra Trading Post – 10%

Jewelry / Makeup

- Ice.com – 20%

- Blue Nile – 10%

- Clinique – 10%

- Avon – 10%

Home

- Home Depot – 10%

- Crate & Barrel – 10%

Food

- Restaurant.com – 25%

- Omaha Steaks – 15%

Other

- Groupon – 20%

- Advanced Auto Parts – 10%

- Dell – 10%

- Lids – 15%

- Drugstore.com – 15%

- HSN – 10%

- Magazines.com – 25%

- Snapfish – 15%

That’s a decent list of merchants and some pretty impressive cash back percentages they’re offering. I don’t shop at many of them but the ones that caught my eye were the 10% back at Advanced Auto Parts, Home Depot, and Dell. If you have a big dollar purchase you need to make for any of those you can get enough cash back to cover the whole sales tax bill and then some.

Again, in order to get these cash back rates you have to do your shopping through their online portal and use the Discover card.

Cyber Monday Deals & Tips

Cyber Monday deals are all over the Web today so the question isn’t where to find the deal but which one to pick! Personally, there’s nothing I need but if you’re looking for deals on Christmas gifts there’s probably a promotion out there for you.

Here are a few places to look for bargains online:

When you’re shopping online that means you’re probably going to be using some form of plastic. Check out these tips for online credit card protection to keep your money safe from hackers and scammers. Most of us have more than one card and some are better than others when it comes web purchases. Make sure you use the best credit card for online shopping when you do find a great Cyber Monday deal.

On top of the deals that retailers are offering today, you can also get discounts and earn cash back from the card you use. Check out these credit card promotions for holiday shopping.

Good luck shopping!

What Are Your 2011 Goals?

Thanksgiving just ended and your New Years resolutions are probably the farthest thing from your mind right now. But we all know times flies so before you know it we’ll be in 2011. If you wait to set your goals until next year has already begun you’ll be starting out behind.

People who start their diet a few weeks before January 1st and hit the ground running have more success than those who begin New Year’s diets two or three weeks into the next year. From a financial perspective, there is spending planning you can do to support your goals for next year – and don’t forget the year end tax moves you can make now.

Of course, one of the keys to achieving your goals is to set specific objectives that you can track and measure progress against. I don’t have all my goals detailed out for next year yet but I will in the next week or two. So, get to work on your goals to make 2011 a productive year!

I know we all like to procrastinate so here are a few personal finance articles you can check out before sitting down to figure out your goals : )

Personal Finance

- The Secret Power of No @ Money Crush

- What is Quantitative Easing? @ Lazy Man and Money

- How Private Are Your Finances, Really? @ Moolanomy

- What Happens to Your Debts After You Die? @ Cash Money Life

- What to Do When the Unexpected Happens @ Eventual Millionaire

- Why Co-Signing for a Loan Isn’t a Good Idea @ Rainy Day Saver

- 60 Reasons Why Personal Finance is So Damn Hard @ Fiscal Fizzle

Investing

- Preferred Stock Selection Criteria – Primer on Preferred Stocks IV @ Million Dollar Journey

- 10 Ways to Invest $1,000 Dollars, Without Putting a Dime in the Stock Market @ Frugal Dad

Career

- Can’t Find a Job? Start a Business @ Couple Money

- Three Ways to Make a Killing Without a College Degree @ Studenomics

- 8 Reasons Why I Quit My Dream Job to Be a Stay At Home Mom @ The Money Crashers

College

- Saving Up for a College Education @ Suns Financial Diary

- How Does A Roth IRA Conversion Affect College Funding? @ The Digerati Life

Frugality

- The Perfect Wedding Doesn’t Cost Much @ Consumerism Commentary

- Six Painless Ways to Cut Your Grocery Bill @ Free Money Finance

- Ten Ways to Get the Most Out of a Vacation @ Narrow Bridge

Shopping

- 10 Inexpensive Christmas Gifts Under $10 @ My Dollar Plan

- The Anatomy of a Coupon @ Frugal Confessions

- 4 Money Smart Holiday Gifts @ Cash Flow Sherpa

- Online Black Friday Sales and Beyond @ Generation X Finance

Thanks to the following sites for including our articles in their carnivals:

Carnival of Personal Finance

Credit Cards and Saving

Festival of Frugality

PerkStreet Financial Review

What is PerkStreet Financial?

PerkStreet is a relative newcomer to the online banking industry. What makes PerkStreet different from those other online banks you’re already familiar with like ING Direct and HSBC?

- PerkStreet only offers a checking account that utilizes a debit card and paper checks.

- PerkStreet does not currently offer any other banking products like savings accounts, certificates of deposit, credit cards, or mortgages.

- PerkStreet’s debit card has an intriguing cash back rewards system.

As an online bank, Perkstreet doesn’t have branches to drive up operating costs so they can afford to offer their cash back checking account.

Online Banking

As with other online banks, you can access your Perkstreet accounts from your computer or your mobile device. Being online does give them the challenge of accepting deposits but they’ve come up with four ways to let you build your account balance. The simplest two are direct deposits and transfers from another bank. You can also send it in using pre-paid postage envelopes or use free overnight check mailing through services like the UPS Store.

Getting your money out is pretty simple. You can use your PerkStreet debit card for purchases or to withdraw cash in their network of over 37,000 ATMs. In terms of safety, your funds at PerkStreet are covered by FDIC up to $250,000.

Perkstreet Debit Card Cash Back

PerkStreet’s debit card offers you cash back on every single purchase you make with the card. That in and of itself should get your attention.

How does it work? It’s all based on your account balance at the start of the day.

If your account balance is $5,000 or more at the start of the day you will earn 2% cash back on every purchase you make that day using the non-PIN method (meaning you sign for the purchase). You also earn 2% for the first three months of having the account regardless of your account balance.

If your account balance is under $5,000 all is not lost. You still earn 1% cash back on every non-PIN debit card purchase.

Cash back is awarded on a variety of options such as Visa gift cards that can be spent anywhere, or for retailers like Target, Best Buy, and Amazon.

PerkStreet Coffee and Music Rewards

You don’t have to get your rewards in cash. PerkStreet also offers the ability to get your rewards in music downloads and cups of coffee. The rewards work out the same except for one catch.

Coffee Rewards

With the coffee rewards you’ll earn 2 cups of coffee worth $2 for every $200 in eligible debit card spending. (You can redeem the rewards at Starbucks, Dunkin Donuts, and others.) That’s $4 on $200 in spending. That’s 2%.

However those rewards get boosted to 5 cups of coffee from every $200 of spend (worth $10, equivalent to 5% cash back) when you spend at select retailers that partner with PerkStreet.

Music Rewards

The music rewards are similar to the coffee rewards. You get 2 songs worth $1 for every $100 in spend. That’s a 2% reward. You can boost that reward to 5 songs per $100 in eligible debit card spending by shopping at specific retailers.

Is Perkstreet Right for You?

Since PerkStreet is a checking account, you’re not earning 1% or 2% on your entire balance in your account. You’ll only earn cash back on what you spend. If you only spend $500 per month and kept your account balance above $5,000 the entire time you would earn 2% or $10 in rewards. If your account balance slipped and you earn 1% rewards on that $500 you’d get $5 in rewards.

Alternatively if you kept $5,000 in a savings account with with a different online bank you would earn 1.1%, or about $4.58 in interest, every month. Without having to spend any money or worry about keeping your account balance above $5,000.

At the end of the day the true benefit you’ll get from opening a PerkStreet account will be determined by:

- how much money you keep in your checking and saving accounts

- how much money you spend every month (specifically on debit cards, not automatic bill pay)

Opening a PerkStreet account is a pretty simple process so one way to see if it fits your needs is to try it out and see what kind of rewards you earn. PerkStreet periodically offers a bonus for opening a new account so you might even get some extra cash for trying them out. To earn rewards with Perkstreet, get more information here.

What Can You Learn About Money From a Turkey Dinner?

The planning and preparation of a Thanksgiving dinner can teach us a few lessons about money.

1) Don’t Be Afraid To Fail

Every year my wife cooks a new dish for the family Thanksgiving dinner. Some years she goes through multiple failed attempts before finding the dish that turns out the way she wants it.

Don’t avoid investing because you’re afraid to lose money. If you’re in the stock market, I can almost guarantee you will lose money. Rather than not investing for fear of a loss, try it, learn from your mistakes, and you’ll find an investment strategy that works for you.

2) Follow The Recipe

We use cookbooks because an expert has already come up with the steps for creating a successful dish.

The steps to successful personal finances are well documented in books and online. The things we need to do are already laid out for us. Follow these recipes and over time your personal finances will turn into a tasty treat!

3) Add Your Own Spices

There are many recipes that have been improved upon by an experimenting chef.

When people create recipes for financial success, they are often guidelines for using money in your life. Not everything you read will apply to or make sense for you. Don’t feel you have to follow the recipe exactly, spice it up a little, modify it to what works best for you.

4) Plan Ahead

Often in the middle of making a dish, my wife realizes she didn’t buy all the ingredients. This results in a rushed trip to the store or sometimes even a not so tasty item.

Planning is probably the most important part of getting your finances on track. Make sure you know how much money you’ll need and when you’ll need it. Otherwise you may find yourself having to borrow to cover costs or unnecessarily spending a lot of money.

5) Ask for Advice

When things aren’t going right with a new recipe, my wife often calls up her mom for some advice on what to do next.

Find someone you can trust and feel comfortable talking to about your money situation. If a question comes up, give them a call and ask their opinion on how to proceed.

6) Don’t be Last Minute

One of the biggest mistakes my wife’s makes is waiting until 2 hours before dinner to start cooking. She’s rushed and more likely to make a mistake. If something goes wrong there is no time to run to the store.

Don’t put off planning your finances. If you wait too long to begin planning for things like college or retirement you will miss out on the ability of money to grow over time and will be limited in the choices you have. Time is a non-renewable resource. Don’t run out of it, there is no going back for a do over.

7) Diversify

We always want to have multiple dishes at Thanksgiving dinner that satisfy all tastes and complement each other.

One of the keys to having a secure nest egg is to have multiple investments that complement each other in terms of risk and market exposure. It is important to be diversified not only among sectors in the stock market but also by having real estate, bonds, and liquid investments.

8 ) Have an Emergency Plan

We have experienced several crises where the first dish doesn’t turn out. If my wife bought the ingredients for several dishes and has enough time, the crisis is averted. If no emergency plan is in place then we show up to Thanksgiving dinner shamefully empty handed.

Be prepared for the unexpected. The best way to do this is to build up an emergency fund that will cover your living expenses for 3-6 months. If life takes an unexpected turn for the worst, it will not be as bad if you have a safety net to catch you.

9) Don’t Over Eat

A common problem at Thanksgiving dinner is eating too much food. This is not something my wife does often but I am challenged by it every year. Everything just tastes so good!

In today’s society of materialism and easy credit, it is easy to spend more money than you have. Resist the temptation to spend, spend, and spend. You may feel you’re missing out in the short term but in the long run you’ll be much happier if you are smart with your spending.

10) Enjoy with Friends & Family

While we spend a lot of time and effort making the food, the important part is sitting down to eat with our family.

While we focus on making and managing our money every day, the most important thing is how we use it to live our lives. Don’t get so caught up in your personal finances that you don’t have time to enjoy the important things in life.

1099-K Form & Small Business Tax Reporting

Small businesses that that accept credit card payments will be getting a new tax form next year, the 1099–K. There are many different 1099 forms, all of which are used to report income to the IRS. You’re probably used to getting at least one 1099–INT form every year from your bank to report interest income.

Until this year, small businesses that used merchant accounts and third party payment services, like PayPal, had no official reporting of the income they received from those sources. Many eBay sellers and other online entrepreneurs have been accepting thousands of dollars in payments every year and they IRS believes that not all of those transactions are being reported as income.

Without 1099s issued by buyers, there is no real accountability for sellers. According to the tax laws they should be reporting their own income, yet some may not be. Enter the new 1099-K form, which takes effect for the 2011 tax year (so it doesn’t take effect for this tax season, which deals with the 2010 tax year).

What is the 1099-K Form?

If you are a seller or business owner you won’t have to do anything really different — other than report your income if you haven’t been. The 1099-K form is something that banks, or third party payment processors, fill out. If you receive at least $20,000 in total payments and engage in at least 200 transactions during a calendar year, the credit card issuer or the payment processor will have to provide a 1099-K to the government. That way, the government can then compare it to what you are actually reporting.

Casual sellers aren’t as much of a concern to the IRS. If you clean out your attic and make a few hundred dollars on eBay, you probably won’t be caught if you don’t report that income (unless there is an audit). However, the IRS figures that there are plenty of serious Internet based businesses paying less than they owe in taxes because payment processors aren’t reporting information on what businesses are making. The 200 transactions/ $20,000 in payments received threshold was chosen because once you are doing that kind of volume, you are probably not just selling things casually.

Will the New 1099-K Form Affect You?

For people like me, this probably won’t change much about the way I do things. Yes, my entire business is conducted pretty much online through PayPal. And yes, I more than meet the threshold. However, I have also been reporting my entire income on my income taxes. I even print out monthly PayPal statements to keep with my tax documents. This would actually make things easier for me; if PayPal sent me a copy of my 1099-K, as well as sending one to the government, I wouldn’t need to print anything out.

For those who have been under-reporting their income, though, this could mean changes. If you don’t fully report your income, you might find that you are audited in 2012 for the 2011 tax year if the 1099-K from a credit card issuer or payment processor indicates that you make more than you say you do.

It is important to understand that the paperwork burden is on the payment processors and card issuers, and not on the businesses or individual sellers. Yes, it is a blow to your financial privacy. But, according to the law, you should be reporting that income and paying taxes on it anyway. The 1099-K is basically a way for the IRS to more effectively track down the people that aren’t doing what they are supposed to. If you’re already properly reporting your income, you shouldn’t have anything to worry about.

Airline Credit Card Rewards for the Holidays

Airline credit card rewards are one way to help ease the cost of travel over the holiday season. The next two months are the busiest air travel time of the year and a lot of travel cards are offering promotions and free flights to help sweeten the deal.

My sister is flying in over the holidays and already had a tough time getting a good price on an airline ticket so the earlier you book the better. If you’re looking for some solid choices for airline rewards, here are some credit cards that might fit the bill:

Chase Sapphire Preferred Card

One of the great things about this credit card is that you can start out with a huge bonus if you spend enough on the card in the first three months. You can use this card for Christmas shopping, and make your travel reservations with this card to earn a free flight for later. (Just make sure that you pay off your balance before any interest has a chance to pile up.)

Other features include using 20% fewer points when you book travel through Ultimate Rewards, a 7% annual points dividend, and 2x points on airfare and hotel on bookings through Ultimate Rewards. The Chase Sapphire card has an annual fee but it’s waived for the first year. – More Info

Southwest Airlines Rapids Rewards Card

I recently wrote about the Southwest Airlines rewards card and the great deal we got on Southwest. You start out with enough for a roundtrip flight, and you can earn two rewards dollars for every dollar you spend on Southwest flights and through Rapids Rewards partners. – More Info

Blue Sky Preferred Card from American Express

This card comes with 7,500 bonus points, which can be redeemed for a $100 statement credit. It also offers $100 in an annual Airline Allowance that can help you cover the fees (such as baggage and in-flight purchases) that come with flying. There are no blackout dates and travel restrictions on points redemption. The Blue Sky Preferred card has a $75 annual fee (offset if you use the $100 allowance for travel fees) and a 12 month 0% intro rate. – More Info

Travel Cards

If you’re traveling to the in-laws for the holidays you might not be excited about the idea of sleeping on their lumpy hide-a-bed and listening to them snore all night. If you’re thinking about staying in a hotel, here are a couple of travel credit cards with some serious rewards.

The Starwood Preferred Guest card from American Express is great for those looking to stay at certain hotels. You can earn enough for two free nights at a category 5 hotel when you start using your card. You can get a third night free when you stay two nights at Sheraton hotels. You get extra points for dollars spent at Starwood Preferred hotels. The Starwood Preferred Guest card has a $65 annual fee (waived the first year). – More Info

The Marriott Rewards Premier card from Chase provides 30,000 points after your purchase, resulting in a free stay. You can receive a free night’s stay every year, and you get extra points for money spent on travel (including airline and rental car purchases). You get 3 points for every $1 spent at Marriott locations and 1 point for every dollar for all other purchases. The Marriott Rewards card has a $30 annual fee that’s waived the first year. – More Info

Southwest Airlines Credit Card Review

The Southwest Airlines Rapid Rewards® Plus - 2 Free Flights card is a great airline rewards card, not only because you get cash and bonus points for signing up but also because its a great airline to fly on.

The Southwest Rapid Rewards program is just one example of how the airline works hard to keep their customers happy. I have friends and family who have worked for Southwest and I’ve seen first hand how much they enjoyed flying for the airline, a welcome change compared to many airlines these days.

Southwest Credit Card Bonus

When you sign up for the Southwest Airlines Rapid Rewards® Plus - 2 Free Flights card and buy your first ticket you’ll earn enough bonus points for 2 free flights. Not only that, when you put your first flight on the card they’ll give you a credit on your card.

Southwest Promotions

Periodically you’ll find Southwest promotions where they have a few day sale on their tickets. In the latest one we bought round trip tickets to San Jose to visit some friends for half the price they would normally be. Of course, with prices that low you’re not earning that many rewards, but it’s fine because you’re saving money!

One word of warning, the deals go quickly. I was on the phone coordinating flights with another couple who’s traveling with us. They clicked the Buy button thirty seconds before I did and got the last of the cheapest seats that day. So keep your eye out for the deals and jump on the flights you want quickly.

Southwest Rapid Rewards

Southwest says that it’s airline rewards card allows you to earn free flights 20% faster than most other airline rewards cards. I don’t know if that’s true but they do have a decent rewards program. You earn double Reward Dollars for every $1 you spend on Southwest flights, Rapid Rewards hotel and rental car partner purchases. All other purchases earn 1 Reward Dollar for every $1 spent.

The way you get your free flight is to redeem your Reward Dollars for Rapid Rewards credit, which can be used towards a free flight to anywhere that Southwest flies. The conversion is 1,200 Reward Dollars = 1 Rapid Rewards credit and you need 16 Rapid Rewards credits to get a free flight.

There are a few ways you can earn bonus points, I already mentioned the two free flights for opening the card. You can also earn bonus points for a balance transfers made within the first three months you have the card. Lastly, Southwest gives you 3,000 Points each year you remain a Rapid Rewards card member.

As I said above, Southwest is a great airline to fly with, not just because of their low prices but also thanks to their customer care. If you feel the same and fly Southwest then check out their rewards card and see if you can get a free flight.

Blue Cash Rewards Upgrade!

One of my least favorite things about our Blue Cash card, the annual cash back redemption will be changing soon. In the middle of next month American Express is upgrading the way that you redeem your cash back rewards for Blue Cash.

Right now your rewards show up as a credit on your statement, once a year, on your annual anniversary of opening the card. The change will allow you to access your cash back after you’ve earned at least $25 of rewards. It sounds as though they might also offer gift cards and merchandise as alternatives to the cash back as well.

It seems that most other cards allow you to get you rewards more frequently than once a year so I’m glad that American Express is considering changing the redemption policy.

Blue Cash Bonus

I also got another email about the Blue Cash bonus they’re offering where you get $25 if you refer a friend and they open a Blue Cash card. The promotion is ending in two weeks, here’s the email:

“It’s simple. When you invite your friends and family to experience Blue Cash from American Express, you can get a $25 Statement Credit for each approved referral. So if you refer 4 friends, you can get a $100 Statement Credit.

Plus, each approved friend or family member can also get a $25 Statement Credit for themselves when they use the Blue Cash Card for the first time.

There is no limit on how many people you can refer—and the Statement Credits you can get. Introduce friends and family to a good thing and watch your rewards add up fast.”

This offer was actually set to expire back in August but they extended it until this month. I suppose they could always extend it again but right now it’s scheduled to end in two weeks.