Should You Use Your Emergency Fund to Pay Off Credit Card Debt?

If you had $10,000 of credit card debt and $10,000 in an emergency fund would you use the emergency fund money to pay down your debt?

My wife’s co-worker likes to spend money. She and her husband have accumulated a $10,000 credit card bill that they just can’t seem to pay off. The wife would like to use the money they have saved up towards the credit card debt but her husband is emphatic that they have an emergency fund to fall back on.

When the co-worker asked my wife for her advice she suggested using some or all of the savings to pay for the debt. She pointed out that a lot of the money they paid towards the credit card bill every month went towards interest. If they paid off the 10 thousand in debt they could put the same money they had been paying in credit card interest towards saving for an emergency fund.

The co-worker agreed that this seemed like financially sound advice; however her husband was set on having an emergency fund at all times. Having an emergency fund is a wise move but does it make sense to maintain this fund while paying high interest charges on the same amount of money to the credit card company? What would you do?

Tax Deduction Baby!

I started working on our family’s tax return last night and answered yes to the question in Turbo Tax about dependents for the first time.

I started working on our family’s tax return last night and answered yes to the question in Turbo Tax about dependents for the first time.

Of course, our son is more than just a tax deduction to us, he’s also a good excuse to leave work early!

Just kidding, being a parent is a wonderful, life-changing experience and we’ve had a ball watching him grow and learn. His smile just makes our day. The tax deduction is just another thing to smile about  Here is what Turbo Tax had to say about the child tax credit:

Here is what Turbo Tax had to say about the child tax credit:

“A child tax credit is available only to taypayers with at least one qualifying child. The maximum credit is $1,000 per qualifying child. If you have more than $11,300 of earned income, or you have three or more qualifying children, and you are not able to claim the full $1,000 child tax credit for each child because of tax liability limitations, you may be able to claim the child tax credit as a partially refundable credit that will reduce your tax liability or increase your refund.”

All I know is that we now have a “qualifying child”. I’ll punch in the numbers and let Turbo Tax figure out the rest.

[photo credit annieseay]

The Law of Attraction + Pursuit of Happyness = Realizing Your Dreams

You attract into your life whatever you think about; your thoughts determine your destiny. That is the key premise of the Law of Attraction as I remember it after watching The Secret last fall. Unfortunately, it seems the results promised from relying solely on the Law of Attraction are full of hyperbole that could potentially lead people astray.

Thoughts + Action = Results

As I watched the inspiring story of Chris Gardner in the Pursuit of Happyness last weekend it made me realize that many things are possible if you just set your mind to it and follow your dreams up with action.

What is frequently missing from the teachings on the Law of Attraction is the effort that is required to make those positive thoughts become a reality. If we can combine the positive thinking from the Law of Attraction and the unfailing determined action that is illustrated in the Pursuit of Happyness we can achieve great things.

Realizing Your Dreams

I remember Jack Canfield talking in The Secret about how he wrote in a bunch of zeros after the 1 on a dollar bill and pasted it to his ceiling above his bed. What if Chris Gardner had done the same thing? Would he expect to have a million dollars come to him, or would he expect one of his fellow boarders at his shelter to swipe the dollar?

The dreams that Chris had were simple. Provide for his son. Escape homelessness. He was defeated again and again in his quest, yet he kept getting back up and fighting the fight. It seems the only thing that kept Chris going through those extremely tough times was the power of positive thought. The image of having a safe, better life for his son drove him forward.

However, Chris’s thoughts were definitely not enough to get him where he imagined. I’m sure there were many others sleeping next to him in the shelter that dreamed of having a place to live who never realized those dreams. The difference for Chris was that he acted on his dreams and wouldn’t take no for an answer.

Take Action Today

Chris is now a very wealthy man that has inspired us with his story and is helping others that are in dire straits. He didn’t achieve his dreams simply by picturing his ideal outcome and waiting for it to materialize. He got to where he is today through determined action.

So go ahead, picture what you want most in life but don’t stop there. Strive to achieve your dreams with unfettered determination and enthusiasm. When you get knocked back, draw on Chris Gardner’s story for strength. Picture how he overcame the odds and obstacles and realize that you can too. Take action today!

Carnival of Money Stories #8

Business

Ybother presents 10 Ways Retailers Make You Pay More! posted at TodaysTen.com: Daily Top Ten List to jumpstart your knowledge, saying, “Think you are getting a good deal? Think again. There are many ways retailers can make you buy more or pay more than you should. If you are a business owner, you are free to set prices for the most efficent profits.”

Daryl W.T. Lau presents Amazon Is Sticking It To Kontera With Context Links Beta posted at How To Earn Money Blogging.

Silicon Valley Blogger presents Silicon Valley Blog About Money, Finance, Geek Culture and Cyberspace posted at The Digerati Life, saying, “And now for something a bit different.”

Ted Reimers presents Benefits of getting an MBA posted at CampusGrotto.

ISPF presents The Birth of a Weekend Entrepreneur posted at Grad Money Matters.

Credit

Priya Jestin presents Live without Credit Cards: 77 Tips posted at Credit Card Lowdown.

Priya Jestin presents Starting Early: The Young Adult’s Guide To Personal Finance posted at Debt Consolidation Lowdown.

Sagar Satapathy presents “Borrowing to Pay Me” and 19 other moronic things people do with credit cards posted at Credit Card Lowdown.

Amy Pedersen presents Debt to Credit Ratios and How they Affect Your Credit Report posted at Your Credit Score Secrets.

Debt

Sagar Satapathy presents Starting Early: The Young Adult’s Guide To Personal Finance posted at Debt Consolidation Lowdown.

Alex at The RE Forum presents Lowest Common Denominator Laws And the Subprime Lending Market posted at The RE Forum, saying, “As the inevitable talk of legislating our way out of the subprime mortgage mess, why are the 90% of performers being left out of the equation?”

Aspeth presents Send Casey Serin To Prison saying, “Like many folks in the blogosphere, I really don’t want to publicize Casey Serin any more than he’s publicizing himself. But I’ve ignored him in these pages for as long as I can stand. I’ll admit that for the first few months of reading his self-aggrandizing blog, I thought it was a fake. I mean, there’s just no way that someone could commit multiple felonies, then create a blog to boast about it.”

frugal zeitgeist presents student life posted at Frugal Zeitgeist, saying, “Hope you like it. Thanks for reading!”

Prince of Thrift presents 70% Attitude, 30% Hard Work posted at Becoming & Staying Debt Free, saying, “Some people are often heard making the claim that they can’t get out of debt. Some even claim they can’t buy a car or house (or whatever) without using credit. Perhaps they have not heard the Henry Ford Quote”

General

Stephanie presents 200,000 posted at Stop the Ride.

Nina Smith presents Sleeping with Money: Who Pays for What posted at Queercents, saying, “Sleeping with Money is our series at Queercents about money lessons learned from past lovers and partners. These include a few escapades…”

Priya Jestin presents Get Divorced while Screwing the Woman out of Everything posted at 1031 Exchange Lowdown.

Big Cajun Man presents Zen, Thomas the Tank Engine and the Art of Financial Planning posted at Canadian Financial Stuff, saying, “Financial planning is an art, and learning to deal with it that way, might be the answer, although what the question was, I am not sure.”

Easy Change presents The Best 400$ I Ever Spent posted at Easy Change.

Arun presents Money DOES Matter posted at Arun is bringing you…Your Daily Remedy, saying, “The correlation between Money and Happiness and an explanations of why Money really DOES matter”

Investing

David J Kosmider presents The Books / Research Papers On My Trading Desk posted at StockWeblog.com.

Bryan C. Fleming presents How to Drive a Mercedes Benz instead of a Hyundai posted at Bryan C. Fleming.

FIRE Getters presents Investing – Total versus Annual Returns posted at FIRE Finance.

Other

Madeleine Begun Kane presents Taxing Times posted at Mad Kane’s Humor Blog.

Alan presents The Worst Boss Ever – Sound familiar? posted at Made to Be Great.

Pushpa Sathish presents What will the Price of College be in 2050? 10 Signs Change is Coming posted at Debt Consolidation Lowdown.

John presents Sleeping with Money: The Ghost of Money Future posted at Queercents, saying, “In this week’s Sleeping with Money series in which we talk about money lessons learned from lovers and relationships, I’m going to turn to the device of allusion.”

That concludes this edition of the carnival of Money Stories, thanks for reading! You can submit your article to the next edition using the carnival submission form.

How to Fix a Gallery Image on eBay

Have you ever listed a bunch of items on eBay through Turbo Lister only to find out the gallery image was wrong for all of them? Don’t panic! Read below to find out how to keep it from happening to you and how to fix the gallery image.

Turbo Lister Settings

Prevention is the best cure. If you choose your Turbo Lister settings correctly you won’t have to worry about the problem in the first place.

Prevention is the best cure. If you choose your Turbo Lister settings correctly you won’t have to worry about the problem in the first place.

I always copy a previous listing and change the details when posting a new item on eBay. The screen shot of the Listing Upgrades in Turbo Lister shows the Gallery Picture box checked and the Gallery URL option selected.

The problem with this setting is that when you copy and paste items, you have to remember to update your url every time. Otherwise you’ll get the gallery picture of the previous item, which is what happened to me recently. I listed ten lacrosse items all with an image of a snowmobile vest, rather confusing to lacrosse shoppers.

The simple solution is to choose the Use Photo 1 option and it will automatically use the first picture that you are displaying for your item.

Changing Your Gallery Picture

What if you already have the wrong gallery picture for the product you uploaded to eBay? Good news, you can change the gallery image in just two simple steps.

1) Go to the Change Your Gallery Image page, Enter your Item Number in the input field shown below, and Click Continue.

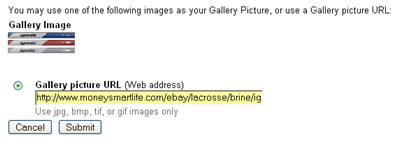

2)Enter the correct web address of your gallery image in the input field underneath the Gallery picture URL option shown below and click the Submit button.

You’ll be taken to another page confirming your change. Congratulations, your gallery image has been fixed, the crisis is over. Happy Selling!

Personal Finance Week in Review – Spring Fever Edition

Spring has arrived; it is a beautiful day here in the Midwest. I’d rather be outside than typing away so we’ll keep this weekly review short and sweet.

Saving more than you spend and increasing your earnings power are two keys to building your net worth. Henry gives us a great visual with a venn diagram for getting rich.

I’m always looking to learn more about growing my net worth by investing so I’ve been tuning into a new mutual fund basics series over at the Sun’s Financial Diary. I think I’m due for a refresher on the basics of mutual fund investing.

The troubles in the subprime mortgage market are making the markets nervous. The Digerati Life talks about the dangers of subprime borrowing and Golbguru discusses how people have abused the subprime lending system.

Generation X Finance also talks about real estate this week. The Baby Boomers have been building equity in the homes for past 10 – 15 years but now that the market is down, who wants to buy their real estate?

There is a new budgeting tool on the horizon named Mint. The Lazy Man went on a tour of their offices and gives us a little insight into the upcoming budgeting tool. One feature of the new tool that piqued my interest was automatic categorization of your expenditures.

I was sad to see that “The Force” method of budgeting hasn’t been working for the Mighty Bargain Hunter so he’s switched to a new allowance approach. We’ve been using something akin to the force method and I don’t like to see its demise. We’ll probably be changing our budgeting means once we drop to a one income family.

Another bargain hunter, Pro Bargain Hunter, gives us some tips in the Art of Negotiating the Lowest Price.

Our Honda has crossed the 100k mark and will hopefully chug along for another 100,000 miles. If not, I’ll turn to the multi-part series on how to buy a new car for the price you want from My Two Dollars.

Below are some blog carnivals I’ve been involved in over the last week or two, check them out for lots of good money info:

- Festival of Frugality at Debt Hater

- Carnival of the Capitalists at Political Calculations

- Carnival of Sports at Breaking News Online

- Carnival of Personal Finance at Tired But Happy and Lazy Man

- Carnival of Taxes at Don’t Mess with Taxes

Okay, it wasn’t short but hopefully it was somewhat sweet. Have a great weekend.

Keeping Your Tax Return Safe

Losing your tax return in a public area is your worst nightmare and an identity thief’s dream come true!

Mobile Tax Return

I use Turbo Tax to do our family taxes every year. I store the tax file on a flash drive so I can access it from multiple computers. In addition, I have last year’s tax return saved off in a pdf format on the drive. This flash drive goes with me to work and back everyday so you can imagine my dismay when it went missing recently.

Tax Data MIA

I searched high and low once I realized the drive was missing. I suddenly pictured identity thieves coming out of the woodwork, finding it on my desk at work or on the floor at the gas station. Having a dishonest person find all this tax information would be a nightmare for me and a dream come true for them.

1040 Safe & Sound

Luckily I eventually located my lost flash drive so my tax data is safe for the time being. I’m taking my tax returns off of the drive after this episode and wanted to publish a warning to anyone else that had their information on some type of mobile device. I had considered the issue in the past but never really took it seriously until it was (almost) too late. Be smarter than me 🙂

Do You Have the Midas Touch? How Can You Turn Money Problems into Gold?

How can we turn our money pits into money fountains? We can take a lesson from the Ringling Bros. and Barnum & Bailey Circus.

Elephants in Manhattan

The Ringling Bros Circus can’t get their elephants into Madison Square Garden via the typical means of customized railroad car when they visit New York City. The circus came up with a solution that turned this logistical roadblock into a wonderful public relations event, walk the elephants into the city. What better way to announce the circus is in town than parading elephants down 34th street of Manhattan? The circus took a problem and turned it into an opportunity, brilliant!

The Midas Touch

Do you have a financial problem that’s bleeding you dry? Sometimes the numbers are overwhelmingly against you and the problem seems insurmountable, however, being creative and thinking outside the Quicken box might give you the Midas touch you need to turn your money problem into gold.

Dieting for Dollars

Have you ever heard of Jared Fogle, the guy who lost 235 pounds by exercising and eating only Subway sandwiches? He was able to turn a life threatening condition into a well-paid career as a spokesman for the restaurant. Although his wasn’t a financial problem it was an overwhelming one. An important thing to note here is that Jared didn’t plan on becoming the face of Subway but his story hit the media and the rest is history. So take a look back at your life experiences and see if there’s anything you can “turn to gold”.

One Million Dollars

Paying for college is a problem many young people face today. Alex Tew was a month away from starting some college courses and wasn’t sure how he’d pay for them when he started the Million Dollar Homepage. Over a million dollars later Alex no longer has to worry about money.

Expensive Taste

Not everyone will make a million dollars or become known across the country but there are things all of us can do turn our money problems into positives. Do you know anyone whose taste is more expensive than their checkbook can handle? Their home or wardrobe may look sensational but now they’re up to their eyeballs in debt? If they really are that good in picking out tasteful arrangements then there are wealthy people out there that would hire them as a fashion or decorating consultant.

Debt Free

Accountability and extra cash flow have both come out of sharing their debt struggles with the world for Tricia from Blogging Away Debt and the King and Queen of Debt as they work towards their goal of being debt free. Sure, they haven’t turned debt into gold but by publicizing their story they will likely be able to get out of debt faster.

What’s Your Thing?

Everyone might have something they can use to flip money problems on their head. What is yours?

What are Your Money Stories?

A collection of stories about people’s personal finance experiences will appear here on Monday, 4/2, in the Carnival of Money Stories. If you have a story of your own to share, you can submit it with the Money Stories form. Looking forward to reading lots of interesting stories!

How 5 Minutes Can Save You $120

Talk about easy money! I spent under 5 minutes on the phone with Comcast today and dropped my cable bill by $20 a month for the next six months. Here are some ways I saved some quick cash with minimal effort.

Choose the Right Technique

I opted for the “Best Buds” approach (how to ask for a lower price) with the customer service rep and it worked nicely. When I called Comcast for a better deal six months ago I relied almost exclusively on the “Mention the Competition” approach and found it effective as well. Every time I contact them I try and read the person I’m working with and feel out the most appropriate tactic.

Be Persistent

Whatever method you use don’t take no for an answer. Today the guy offered up the promotion to me with no prompting, maybe influenced by our friendly banter. However, in the past, I’ve had to ask for a discount and my first several requests have all been turned away with one excuse or another. Repeated attempts at getting a better deal have ended successfully for me so far.

Get a Name

This is a new one for me because in the past I’ve had to put the heat on the customer service rep to get what I wanted and probably burned bridges. However, at the end of the cordial call today, the guy gave me his name and said to call if I ever had any problems or questions. Since he was so agreeable, you’d better believe I wrote down his name and will ask for him when I call back in six months.

On the flip side, if they’re difficult to deal with and make you really work for your discount, you may want to avoid them in the future. Make note of their name and if they answer the next time you call then hang up and try again.

Save Some Money

As you can see, its not hard to do and only takes a few minutes. If you’re paying too much for cable (if you’ve never called Comcast before then you probably are) then give it a shot and put the extra money to work for you instead of them!