Mutual Funds for the New Investor – SLASX, HOLVX, TCEIX, AMAGX

Where should you make your first investment when just getting started investing?

If you don’t have a lot of money to invest and aren’t sure where to put it, don’t let that stop you from getting started! In the December edition of Smart Money magazine, Reshna Kapadia takes a quick look at four no-load mutual funds that have minimum initial investments, low fees, and have performed well in comparison to other similar funds:

1) Selected American Shares (SLASX)

Minimum investment -$1,000

Expense Ratio – 0.90%

5 Year Return – 9.34%

2) Homestead Value (HOVLX)

Minimum investment – $500

Expense Ratio – 0.76%

5 Year Return – 11.10%

3) TIAA-CREF Equity Index (TCEIX)

Minimum investment – $50 (If signed up for automatic investment of $50 month)

Expense Ratio – 0.26%

5 Year Return – 7.01%

4) Amana Growth (AMAGX)

Minimum investment – $250

Expense Ratio – 1.41%

5 Year Return – 11.38%

Thanks to Reshna Kapadia for doing the initial fund screen. I don’t have any experience with these funds but you can examine them in more detail with the links above, financial data shown is from Google Finance.

The new year is approaching, if you’ve been meaning to begin investing but haven’t gotten around to it yet, make a New Year’s resolution to research these funds and get started!

You can also check out my earlier discussion on Vanguard’s STAR fund for those just new to investing.

Act Now and Double Your Charity Donations for Half Price

Wouldn’t it be nice if you could donate $100 to your favorite charity and have them get a check for $200?

Matching Gift Program

Some corporations have a matching gift program where they will match their employee’s charitable donation dollar for dollar. You can search MatchingGifts.com to see if your employer has such a program.

Free Money!

Once I discovered that my employer would match my gifts I felt guilty not utilizing it, I was basically throwing away free money for people that needed it!

Things to Consider

Pre-Approval

Corporations typically only match gifts to charities that are on their pre-approved list. Check with your Human Resources department to see if your charity is on their list.

Meet the Deadline

The donation must be made prior to the end of the calendar year. Your Human Resources department may have their own policies, be sure to check with them.

Follow the Rules

In order to be eligible for the matching gift through my company, I had to submit the donation check to my employer who then matched the money and forwared it on to the charity. If I donated directly to the charity they would not offer the match.

Act Now!

There are still a few more business days before the end of the year take advantage of your company’s matching gift program and double your donations!

Carnival Highlights – 12/21/2006

I’ll start out with the The Festival of Frugality #53 hosted by Amy Clark over at momadvice.com. Amy enjoyed my contribution on saving money on baby’s Christmas pictures and gave it one of the best posts of the week! Alright Amy!

One of the things I had the most fun writing this week was Three Investment Rules I learned from Texas Hold’em. This article was included in the Carnival of Investing #53 over at Lazy Man and Money.

The 66th Carnival of Debt Reduction was hosted by Debt Consolidation Lowdown where I wrote about The Good, Bad, and Ugly of Credit Card Alerts.

And last but not least I talked about how How persistence will make you rich,someday at the the Carnival of Personal Finance #79 hosted by KirkWash.

Thanks to everyone who hosted and enjoy the articles!

How Christmas Letters Can Make You a Happy Millionaire!

How many times have you read, “Past performance is no guarantee of future results“? Unlike investing, reflecting on your past performance in life and basing your actions on where you want to be can help guarantee future results.

Our Annual Report

Like a corporation’s annual report our yearly Christmas letter records the accomplishments, setbacks, and future plans for the three shareholders of our family.

Every year as I sit down to my New Year’s Resolutions the review of past Christmas letters provides vital insight that helps craft next year’s goals. The Christmas letters reveal where we were headed, where we fell short or changed direction, and the trends that have molded our lives for the last few years.

Show Me the Money

So how does this make me a millionaire? As a 29 year old couple, my wife and I have built up a net worth of just over a quarter million dollars. I’d say we’re on track to hit one million and beyond!

Making it Happen

Of course reflecting on old Christmas letters is a strategic exercise and won’t make you any money at all. However, the trends and directions you recognize in the letters can help you create concrete steps towards your goals with your New Year’s resolutions.

We’ve made progress towards a million not by earning a lot of money but by saving, spending wisely, and investing. Basically following many of the concepts outlined in The Millionaire Next Door.

You Can’t Buy Happiness

So what will make me a happy millionaire? When I look back over the Christmas letters the things that make them valuable are reading about getting married, having a baby, and building memories with families and friends. Basically just living life.

The chronicles of earning our Masters degrees, career promotions, or successful projects at work are necessary steps towards becoming millionaires, however they’re not what I’m most proud of.

Be Rich and Happy

Being happy is more important to me than being a millionaire. However, if you review those Christmas letters to see where your life is headed, build your New Year’s resolutions to keep you on track, and stick to them then you can have both. You can become a happy millionaire! For a great source of personal finance tips or advice to help make you a millionaire visit pfblogs.org or moneyblognetwork.com.

Blogging is Costing Me Money, But I Don’t Care!

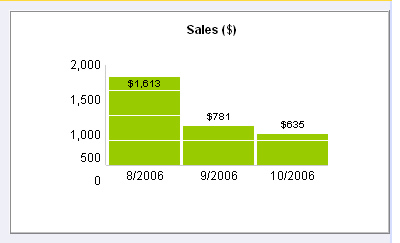

This chart is not the trend you want to see when you’re trying to build your net worth:

I stumbled across the personal finance blogging community in September and started Money Smart Life the next day. You can see an obvious correlation between pfblogging and my decrease in eBay sales. eBay hasn’t posted a November numbers summary yet in the Sales Manager but let me tell you, the slide continues.

No Worries

As I mention in the title, I’m not too concerned with the slump. I know once I put the time into procuring and listing inventory that sales will rebound. Of course I need to get on it relatively soon so my wife can stop stressing about all the inventory piled up in the garage and office.

Blogspiration

As I’ve said, using money to live our lives, instead of living our lives around money is something I’ve thought about my whole ?adult? life. The time it takes to share my tips and experiences is well worth the good it may do others. I’ve discovered that it does take considerable time and admire robo-bloggers like Free Money Finance and The Simple Dollar that crank out the posts with super human ability.

Calling All Readers

Thanks to those that read a Money Smart Life, please let me know any specific thoughts on how I could the spread the money smart life mantra more effectively 🙂

If you’re a first time reader ![]() subscribe today, I have big plans for the future! Now if I can just get my eBay store back up to speed, my job slows down, and the baby stops crying I’ll have time to realize the plans!

subscribe today, I have big plans for the future! Now if I can just get my eBay store back up to speed, my job slows down, and the baby stops crying I’ll have time to realize the plans!

And lastly, thanks to Henry at Binary Dollar for being the first to add me to his Blog Roll! I have favorite sites I’ll add once my new theme is up. Yes, I’m just as excited to get rid of this boring theme as you are!

Christmas Cards, Small Investments with Great Rewards. Five People You Can’t Forget!

There are some people that touch your life in a major way. The Holidays are a great time to show them your appreciation for how they make your life better. Sending them a Christmas card or even a holiday treat not only says thanks but could even get you some special treatment next year :). As you’ll see below, a kind gesture is a simple investment that could pay off big time. They may not all apply to you but make sure you send something to those that do:

Babysitter

What is most important to you in this world? Let your babysitter know how much you value the care they give to the ones you love the most. A simple card can help get your child the most attention in the nursery!

Teacher

Is your kid going to grow up to be President? That partly depends on what knowledge and influence Mr. or Ms. Teacher pass on to them. Teachers work hard to mold your kid’s minds all year long, let them know you are grateful for all they do. The extra attention it could earn them may help put them on a path to greatness!

Doctor

How can we enjoy life if we’re not healthy? Your doctor provides one of the most valuable services of all, keeping your body up and running. Letting them know you appreciate their time and expertise will inspire them to keep up the good work. Maybe a special gift now could even help you move to the front of the 2 week waiting list for an appointment next year!

Financial Planner / Accountant

Money feeds the engine of life. These financial professions help you go faster and farther on your journey. Just because they’re number crunchers doesn’t mean they’re robots! Accountants have feelings too you know J Let them know how thankful you are for their financial assistance with a card or plate of brownies. Who knows, maybe they’ll go the extra mile to research an additional deduction or two next year or spend extra time finding the best mix for your investment portfolio.

Parents

Thanks to the ones that made it all possible, without them you wouldn’t be here! As a new parent, I’m learning the time and sacrifice required of a mom and dad. I’m sure it only gets harder so make sure to thank them for making your life what it was today!

Anyone else? Who did I miss?

Your Money or Your Life? Life is Short!

In the second edition of Your Money or Your Life we get three reminders of how to balance spending money and living life, compliments of The Simple Dollar, One Frugal Girl, and Mapgirl.

Life is Short

I often get so caught up in the rush of the daily grind that it’s easy to overlook or take for granted the most important things in life. It’s nice to take a step back and reflect on what we really want out of life. Trent asks us, what would we do if we only had a year to live? He challenges us to figure out what the cost would be of doing only those things most important to us for a whole year. Then come up with a plan to save up the money to live that life!

A whole year at a time is a big chunk to bite off. A few “minor” issues such as insurance coverage, mortgage payments, and buying diapers come to mind. It’s a good idea though. I think I’ll do this on a smaller scale, maybe do 3-5 weeks in a row every year. Thanks for the motivation Trent!

Work vs. Family

High salaries and recognition are nice but at what cost? One Frugal Girl makes the list a second week in a row as she reminds us that salary is not the most important factor. In a world where salary and recognition are often of utmost importance, she notes how we often miss ballet recitals or little league games for work and questions whether it’s worth the “rewards of plushier offices and more money.”

With a new son, this issue is front and center in my life. Long nights and weekends at the office are no longer something I’m interested in. Whether it affects my career is no longer a major concern, being with the new little guy is what matters most!

Gift Giving

Mapgirl reminds us that spending money on a gift for someone you love is only part of gift giving and that how much you spend is not the most important part. She asks:

“Do you equate the value of a gift with the amount of love the giver is showing? I was always taught that it is the thought that counts. I don’t think those are only comforting words for a disappointing gift. I think when a gift has been given careful thought, it really shows.”

An appropriate topic this Christmas season. Hopefully I can give gifts to make my family happy, not make the retailers rich!

Three Investment Rules I Learned from Texas Hold’em

While learning to play Texas Hold’em over the last year I picked up several basic concepts that have held true and helped me improve my game. Three of these concepts can be applied to helping improve your investment returns as well.

1) Know When to Fold’em

Sometimes in poker you start out with a promising hand but after you see the first few cards it doesn’t look so good after all. When you’re dealt a suited Ace, King in poker your heart leaps. When the next cards are 5, 7, 9 your high hopes are dashed. At this point you may have already invested money into the hand through a blind or a raise and it’s hard to let go but many times it is the best move.

Have you ever bought stock in a company with great potential but over time the profits never materialized or the company lost its way? It’s hard to let the stock go but if the fundamentals aren’t there then it’s time to sell.

Know when to sell a good investment gone bad.

2) Know Your Odds

Experienced poker players know the odds of winning each hand they play. They know the probability of winning and weigh the risks against the potential rewards. It takes time and practice to learn the odds but knowing them gives you the edge you need to win.

When you’re investing in a company, knowing the fundamentals is of utmost importance. If you don’t know the fundamentals, don’t invest. Why trust your money to an investment without knowing there is a reasonable probability you’ll make money?

Know your risk/reward ratio before buying a stock.

3) Be Patient

One of the comon temptations in poker is to bet on marginal hands when you’re just not getting good cards. You want to be playing the game, not watching it! However, I’ve learned that you’re better off in the long run ignoring the the bad opportunites and waiting for the good ones.

Poker games are won one hand at a time, just like investment portfolios grow over time with smart, steady investments. Don’t bet all your money on the first three hands. In other words, don’t approach investing with the attitude that you’ll get rich quick. Steady investing over time leads to wealth.

Investing regularly and in good opportunites wins the race. Don’t try and get rich quick.

Invest to Win

Obviously there is a difference between gambling and investing but using these three concepts will help reduce your investing stress and increase the return of your portfolio.

If you enjoyed this post, subscribe to my RSS feed for daily updates!

Carnival Roundup – 12/15/2006

It was Carnival Crazy this week at Money Smart Life:

- I talked about budgeting over at the Carnival of Debt Reduction

- Discussed what your 401k provider isn’t telling you at the Carnival of Investing

- Warned others about the dangers of automated bill pay at the Carnival of Personal Finance

- Talked about real vs fake Christmas tress at the Festival of Frugality

- And finally covered how to double your savings on Christmas shopping deals at the Carnival of Shopping

Enjoy!

The Good, Bad, and Ugly of Credit Card Alerts

How do you remember to pay your credit card bills?

Some credit card companies have a service that alerts you to key events in the cycle of your credit card bill. I use these alerts for one of my credit cards and have had mixed results.

The Good

The best alerts come 7 days before the bill is due. These alerts are very helpful, just enough time to login to my online bill pay account and setup a payment for the credit card bill. I call them the best alerts because I know I haven’t spent any money yet 🙂

I am also alerted when my credit card payment clears or if I am late paying my bill. The late payment alert can be valuable but it can also lead to problems, more later on.

The Bad

The alerts can be setup both as automated phone messages and as text messages. At first I was receiving both. Although my cell phone plan is a great deal, it doesn’t include text messages so Sprint PCS was charging me 10 cents per alert! I quickly turned that feature off.

The Ugly

My bad experiences with the credit card alerts have been due to technical problems and my over-dependence on technology. Over time I became somewhat reliant on the 7-day alert to remind me to pay my bill.

Wouldn’t you know, one month the trusty 7-day alert never came and I completely forgot to make the payment. Of course the late payment alert saved the day. I was only a day late and able to talk the company out of the late payment fee.

This month, I received a late payment alert on Sunday afternoon. Monday morning I set up an immediate electronic payment. Later I discovered the alert was an error. They did receive my first payment so I had paid my bill twice! Of course they won’t send the money back it just goes as a credit towards future purchase. Unfortunately now I don’t have the money in the right account to pay my other credit card bill so I’ll have to do some quick cash transfers.

Verdict

Overall, the alerts have been more of a help than an issue. As long as I don’t become dependent only on the alerts to remember the payments, they are a good tool to manage my credit card payments to avoid late fees and interest charges.