Investing on a Budget

How to invest with just a little money is a common question for people investing on a small income or trying to balance investing vs paying down debt. Just because you don’t have a lot of money doesn’t mean you can’t invest, however it does require you to be smarter in your investment strategy. So today I’m going to write about investing on a budget. There are five core concepts I’ll cover and if you follow them you should be able to invest on just about any budget.

Core Concept #1 – Emergency Fund

I’m not the first person to discuss this concept–it’s actually a part of the “debt snowball” idea created by Dave Ramsey. But it’s still a core value in being able to invest on a budget. Before you can invest, you need to have sufficient funds in savings (in case of an emergency) so that you won’t have to tap into your investments the first time your car breaks down or you need a new roof for your house. This is particularly important in terms of tax affecting your investments.

Core Concept #2 – Researching Investment Minimums

If you’re investing on a budget, you might want to go with one of the large no-load mutual fund companies such as Vanguard, T Rowe Price, or Fidelity. You’ll probably be upset to learn that most of these companies require a minimum investment of several thousand before you can even begin investing. Knowing this up front will help you make a decision as to when and where to invest. In the meantime, keep setting money aside in a a “pre-investment” account – you’ll get there sooner then you think. Something else to consider is that the required minimums are often lower if you’re opening a retirement account like an IRA.

There are also companies like ShareBuilder and Betterment that will let you invest just a small amount each month. The two work a little differently, ShareBuilder charges a $4 fee for each investment you buy and Betterment charges 0.9% of your investment annually. Here’s a ShareBuilder review and you can look for a Betterment review on this site later this month.

Core Concept #3 – Pay Yourself First

– If you don’t pay yourself first, you won’t pay yourself at all. Period. Again, this isn’t a concept I created (I’m not even sure who did), but it works. A good number is to try and set aside at least $50.00 each month for your investments. If you can’t afford that then you’ll have to do some digging to come up with the money.

Is your cable $50.00 per month? Maybe you could downgrade to save $20 a month and then you’re almost halfway to $50. When you’re on a budget you have to make trade-offs – you have to decide if you’re willing to make cuts to start an investment portfolio or retirement fund. It’s up to you to decide if investing is feasible or not – with some juggling, hopefully you’ll find that its possible. If not, the focus has to be on increasing your income (which of course is always easier said than done).

Core Concept #4 – Diversify

I’ve been over this concept before in prior posts on this site, but it’s just so important when you’re investing on a budget. When you’re investing on a budget, you likely won’t have the funds to survive one big investment mistake. You’re only chance to get the exposure you need, across a wide cross-section and variety of sectors and investments is to diversify.

As I mentioned ealier, I think the best way to accomplish this task is to invest in a low cost brokerage firm, my favorite is Vanguard. When you only have a little to invest it’s even more important to keep your costs/expenses as low as possible. A diversified mutual fund with a brokerage house will help you achieve both these goals with little hassle.

Core Concept #5 – Get Started as Soon as Possible

Since you won’t have (at least for the foreseeable future) the ability to fully fund most of your investments, you’ll have to obtain your investment and savings value through time rather than volume. The sooner you invest, the sooner you can start the compounding interest that you will need to carry you through to achieve your individual investing goals.

Conclusion

These are, in my opinion, the five core principles of investing on a budget. After you have mastered these concepts, you should be able to start investing now or in the near future–even on a tight budget. I’ve found that there’s always a place I can cut money or a way to earn some extra cash. I understand too that some budgets have more flexibility than others.

As always, it’s important to meet with an appropriate expert prior to making any such important decisions. Best of luck as you embark on investing on a budget. With time, you may realize you don’t even miss the extra money you are investing rather than spending. That sacrifice now should pay dividends, both financially and in your life, for years to come.

Market Capitalization: An Overview

As you sit and watch the financial news, or read other financial articles, you will constantly hear about this large-cap company or that small-cap, etc. What do these terms mean? Which companies fall where? And most importantly, why does it matter?

The first thing we need to do when discussing this topic is define what market capitalization is. This term represents the size of a corporation in regards to value. The market cap of a company is equal to the share price of its stock multiplied by the shares outstanding. For example:

Company ABC stock price: $10.00

Company Shares Outstanding: x 10,000,000

Company Market Cap: $100,000,000

Market Capitalization

How a company is described in reference to market cap depends on the size. There are five categories that are regularly discussed. So much so, that there are indexes, mutual funds, ETFs and sectors built around these. These numbers are not set in stone and may even vary by country. The following would be a good benchmark to use for comparison:

Mega-Cap: Over $200 billion

Large-Cap: $10 billion – $200 billion

Mid-Cap: $2 billion – $10 billion

Small-Cap: $250 million – $2 billion

Micro-Cap: $50 million – $250 million

Mega-Cap Stocks

These are truly the biggest companies in the world. Names like Microsoft, ExxonMobil and Johnson & Johnson fall into this category. It used to be that these big companies were considered pretty safe investments “too big to fail” if you will. We found that not to be the case over the last few years.

Large-Cap Stocks

This is probably the most popular segment in regards to investing. The S&P is built on these stocks. Names like Wal-mart, Coca Cola & Apple fall into this category. As discussed in a previous post, there is an argument for index investing and just taking advantage of the natural growth and movements of the market. The more sophisticated investor will disagree, but then not everybody falls into that category either.

Mid-Cap Stocks

This segment is probably the most over-looked by the average investor and it is possibly their biggest mistake. Mid-cap stocks benefit from being like their larger brothers, in that they have established track records both in financial statements and share price. They are less risky than smaller companies, and yet they have only truly seen the beginning of their growth. According to Morningstar, the Mid-Cap 400 Index has outperformed the S&P in both the 5 year & 10 year time frames.

Small-Caps/Micro-Cap Stocks

These segments are the area where many sophisticated investors and day traders play. The volatility is much higher here and the potential to wither win big or crash and burn is much higher. The hard part here is the limited information available for many of these stocks.

Each of these segments of the market has their reasons why you should or should not use them in your portfolio. Whether you do or not is entirely up to you. At least now when you hear those analysts rattle on about small-caps outperforming, you will know what they are talking about.

Investing vs Paying Off Debt

Investing vs paying off debt is a decision that many of us are faced with but we’d like to avoid. We’d rather earn enough money to both pay off our debt and save signifigant sums of money at the same time. Unfortunately, that’s not the reality for many of us.

Your Burden of Uncertainty

If you’re anything like me, then your finances probably feel like a constant tight-rope walk. It’s like in Monopoly when you’re not sure if you should build more houses or wait until you make it past the other players hotels first. That in-between feeling can be one of the most difficult things to deal with in mapping out your financial future.

I always say when playing Texas Hold’em that I want my hands to be either really great or really bad so I don’t get caught in between. Of course there’s a lot more (hopefully) on the line when it comes to balancing savings with debt repayment. This post will discuss some of the things you might wish to consider when determining how to allocate your resources between paying down debt and wealth building.

Balancing Investing With Paying Off Debt

For those of you who are not yet familiar with my story, my wife and I both currently earn decent salaries, but we also have a combined six figure student loan debt obligation. Tired of the debt/savings guessing game, I recently met with a financial planner to discuss the issue of balancing debt with wealth building. I suggest you meet with your own expert, but I wanted to address some of the concerns I was advised to consider when allocating resources. I am twenty-seven years old, and of course everyone’s balance of debt repayment vs. wealth creation will be different. But I think this will remind you of some of the factors to consider.

The Biggies: Age, Salary, Debt Load, Retirement Age

These factors shouldn’t shock anybody as they’re pretty standard considerations. When considering how much money to allocate to debt repayment, you should have an overall goal of when you wish to retire and the type of lifestyle you hope to enjoy once you do retire. Your age, salary and debt-load will all be factored in to determine the achievability of your investing goals.

Interest Rate on Debt

Another factor you will need to consider is the interest rate attached to the debt. Obviously if you have burdensome credit card debt, then it might be best to forego wealth creation–because it is unlikely you will be able to earn a higher rate of return on your investments than you owe on your credit cards.

Other Debt Factors to Consider

Is your debt dischargeable in bankruptcy? Does the debt provide significant tax benefits? How about this important question: are you able to meaningfully consolidate your debt or perhaps convert it into a user-friendly home equity line of credit? You need to know everything you can about your debt to determine how quickly you should try and pay it off. You must also consider how many years you have left in your payoff schedule.

Do You Have An Emergency Fund?

It’s always important to remember that when you pay debt off in advance, you are possibly taking away your ability to fund a future emergency. For example, my student loan debt repayment is $1,500 per month. That amount will be consistent until the day I pay the debt off in full. If I pay an extra $5,000 towards my principle, it only changes the repayment schedule timeline, not the monthly payment amount. So, even if I paid an extra $5,000, the next month I will still owe $1,500 for my monthly payment.

What I might not be able to do, however, is now survive a job loss. Consider also the flexibility of your debt. Federal student loans are often very flexible in terms of changing your repayment schedules or if you are seeking forbearances or deferments. If you lack an emergency fund then are there other means of support such as help from your family if things ever took a turn for the worse?

Small Window of Opportunity for Retirement Savings

Remember that you only have a small window when it comes to maximizing your retirement savings. In your twenties, you have a once in a life-time opportunity to make your money go further by investing as much as you can into your retirement funds now. The miracle of compounding interest should then help take care of the rest. The financial planner that I spoke with recommended that my wife and I pay $4.00 towards savings/retirement savings for every $1.00 that we put towards paying off our (massive) debt early.

Your Level of Comfort With Risk

As stated above, your comfort with investing risk will determine how much money you mentally need to keep in savings. It will also affect how aggressive you will be in choosing your investment allocation. Generally, investing in more aggressive stock-heavy retirement plans will lead to a higher rate of return and thus make the path to retirement easier.

Employer Match

If you receive a 401(k) match or other similar benefit, then you are really “throwing away free money” if you do not maximize that benefit each year. This too is a consideration when balancing investing with paying off debt early.

Conclusion

As I stated at the beginning, this is by no means a complete list; but I wanted to go over some of the basic factors you should consider when sitting down to map out how you will balance investing/savings with paying off debt early. What other factors would you personally consider in reaching this determination? How do you personally balance investing with paying off or paying down debt?

How to Track Your Investments

Two key parts of investing are how much money you contribute and how your investments perform. Tracking that performance will show you how much more money you need to put in to to hit your investing goals. But how important is monitoring your investment performance? Should it be done on an annual, quarterly, monthly, or weekly basis? Or should you just leave well enough alone and just keep investing your funds periodically?

Why You Should Track Your Investments

There are two great reasons to keep tabs on your investments, keeping the right balance of investments in your portfolio and tracking progress towards your goals.

Know When to Rebalance

It’s recommended that you rebalance your investments at least once per year to keep your asset allocation in line with your investment risk profile. Take the mix of stocks and bonds in your portfolio for example. If your goal is to have 70% of your investments in stocks and 30% in bonds, it won’t exactly be that amount every day. If stocks skyrocket, your balance might swing to 77% stocks and 23% bonds. Rebalancing is selling off some of the stock investments and reinvesting the dollars into bond investments to get back to a 70%/30% mix. If you don’t monitor your investments, you won’t know how badly your investments need rebalancing.

Track Progress Towards Your Investing Goals

Without knowing how your investments are performing, how can you track your progress toward your retirement goal? If you have a great stretch of years with large growth in your investments that puts you ahead of your goals you might decide to invest some of your retirement savings in something other than the stock market. On the other hand, if your investments have poor performance you might need to put more dollars in every year. If you aren’t tracking those investments you don’t know whether or not you need to adjust your investment strategy.

Why You Shouldn’t Monitor Your Investments

Keeping tabs on your investments is a great thing, but you can easily overdo it. Constantly monitoring your investments can be an emotional drain and can cause you to make rash decisions.

Emotional Reactions

The stock market and your portfolio are going to have regular ups and downs. Sometimes severe ups and downs. The worst thing you can do when your portfolio takes a serious change is to panic. If you are constantly monitoring your investments you are more apt to try and make constant changes. You are better served to set a steady course and not panic when things change drastically overnight.

So we’ve looked at the good and bad implications of keeping regular tabs on your investments, now we’ll talk about a few different ways to track your investments.

Investment Brokerage Firm

The easiest way to monitor your investments is through your brokerage firm or mutual fund company. Since they hold your investments this requires the least amount of setup, they have a record of what you own and report on it. Some fund companies make tracking tools available even if you don’t hold investments through them – for example the T Rowe Price Portfolio Manager.

Whether through paper statements or online, you should be able to get access to your short and long term performance through your brokerage account. Online access is obviously easier, but you have to be careful that you don’t become obsessed with checking it every single day. One nice thing about keeping your paper statements is that you can sit down with 12 months or even several years of statements and look back at how your money has performed.

You don’t actually gain or lose any money on an investment until you sell some shares and realize your profit or loss. When you sell some of your investments you’ll need to know their cost basis come tax time so you can report it to the IRS. Your investment company is the best place to get this information, starting this year brokerages are required to report cost basis to you and the IRS for any stocks you sell. The following year they’ll have to report it for ETFs and mutual funds – the year after that for options.

Free Portfolio Tracking Sites

What if you aren’t using just one brokerage? What if you want to track your 401k, your Roth IRA, and an old 403b that you never rolled over? One brokerage firm may not be able to handle tracking investments you don’t have with them. Thankfully there are a wide array of free tools online where you can enter your portfolio positions and track them that way.

Of course the downside of this option is that you have to setup the account and enter all your investment information to get started. Any new investments won’t be automatically added to be tracked, you’ll have to remember to enter those.

Many of the major financial publications offer some form of free portfolio tracking. You can track your investments in varying degrees of detail on Kiplinger.com, SmartMoney.com, Money.com, and Money.MSN.com. Both Google and Yahoo have finance sections where you can setup your portfolio and track it’s performance.

Something neat, but kind of spooky, I noticed about Google Finance – it remembers the ticker symbols you’ve looked up using the search engine and shows you the latest quotes for those stocks, mutual funds, or ETFs.

Two tracking services that are free but offer more functionality than the ones mentioned so far are Yodlee Moneycenter and Mint.com.

Premium Investing Websites

There are premium websites such as Morningstar where you can not only enter your investment positions and track them, but you’ll get overall advice on the quality of those investments. Morningstar rates mutual funds and individual stocks. You’ll be able to dig deep on the fundamentals of a company to decide whether or not it belongs in your portfolio.

Investment Tracking Software

Although the web has made it easy to track your portfolio online and have investing data at your fingertips many people still like to use a basic spreadsheet to keep track of their investments. Microsoft Excel actually has a whole library of financial formulas you can use if you want to run your own numbers on your investments. (If you don’t want to pay for Excel you can use the spreadsheet in OpenOffice or use the free web-based spreadsheet in Google Docs).

Intuit, who runs Mint.com, also has some popular personal finance software for the desktop you can use to track your investments. While you can use Intuit’s QuickBooks to keep tabs on your investments most people are probably better off using Quicken. Quicken is cheaper than QuickBooks and is geared more towards the average investor.

Check Engine Light Roundup

My check engine light came on last week during my morning commute to work. I spent the rest of the drive imagining all kinds of things that could be wrong and how much each one would cost to fix. A co-worker suggested I go to an O’reilly or AutoZone and ask them to put on their code reader and check the error code for me.

The problem came back as a bad O2 sensor, the guy at Autozone pointed out I had multiple sensors on my car and finding out which one to replace would be the trick. So my next step was to take it to the dealer dealer to figure out which sensor it was and how much it would cost to fix.

Taking it to the dealer might have been a mistake, they charged me a $80 diagnostic fee just to plug it into their computer. I’m not sure what more they do for diagnostics than AutoZone but $80 seems pretty steep. Anyhow, they came back and said I needed a new catalytic converter, which would run me right around $1000. I declined the repair so I could take my car to another shop and get a second opinion before dropping a thousand dollars.

Error Code Readers

The dealer didn’t clear my error code but driving home from work yesterday my check engine light switched back off on it’s own. I’m assuming it’ll pop back on again since I didn’t do anything with the O2 sensors or catalytic converter so I know my problem isn’t resolved. However, I did learn that it’s probably worth while to invest in a OBD II code reader so I can check future error codes myself on my aging Accord.

I don’t know much about cars but my co-worker swears by the Haynes manuals and Google for looking up and diagnosing the error codes. I’ll still need the professionals to fix the issues but at least I can check them out on my own. The biggest reason is that I want to keep an eye out for anything else that might go wrong. I know the O2 sensor and catalytic converter issues won’t do any major damage to my car but I don’t want to assume the check engine light is for those problems and then miss something major.

Financial Check Engine Light

Although it is stressful when the check engine light comes on because you know it means you’ll probably be spending some money – it is helpful to have the warning. It can also be useful to have warning indicators for your finances. The ones I use most frequently are alerts from my bank and credit card company that let me know if payments are due or late or balances are low. Rather than having to login every day and check for any outstanding issues, I rely on the alerts to tell me when I need to worry about something.

Just remember that similar to the check engine light in your car, ignoring the warning signs can end up costing you money! Here are a few recent personal finance articles from around the web you might want to check out.

Retirement

- Planning for Your Financial Future in Retirement @ Generation X Finance

- Early Retirement Extreme: Review @ Brip Blap

- 10 Reasons to Work Part-Time in Retirement @ Free Money Finance

Personal Finance

- Bitcoins: The Future of Money or End of the World? @ Lazy Man & Money

- 5 Potential Costs of a New Job @ My Dollar Plan

- Reader Mailbag: Paying Off Student Loans vs. the Mortgage @ Frugal Dad

- 3 Ways to Declutter Your Desk @ Currency

- How to Maximize Frequent Flyer Miles @ Currency

Investing

- How Stock Trading Works @ Suns Financial Diary

- How To Get Started With Dividend Reinvestment Plans @ The Digerati Life

- Keeping Up With the Buffetts @ Five Cent Nickel

- Technical Risk Ratios @ Million Dollar Journey

- The Value of Diversification Beyond The S&P 500 @ My Money Blog

Thanks to Chris Gaddis for having me as a guest a few weeks ago on the Money Train morning radio show, and I’d also like to thank the following sites for including posts from Money Smart Life:

- How to Invest Without Wetting Your Pants @ Personal Finance Journey

- Investment Risks & Your Money @ Miss Thrifty

- Investment Asset Allocation 101 @ Well Heeled

401k Investment Alternatives

Investing for retirement is critical if you don’t want to rely on Social Security alone to make ends meet in retirement. Setting aside some money today will allow it to grow over time into a much larger amount thanks to compound interest.

One of the most popular types of investment accounts to use for retirement is an employer-sponsored 401k plan. Using a 401k for retirement is usually an simple option. You fill out a form at work and the money comes out of your paycheck every time you get paid. You don’t have to actively think about investing, and some employers automatically enroll employees to invest 3% of their pay.

But what if you are not a fan of your 401k? What if your employer doesn’t offer a match, or your investment options are poor? Here are a few alternatives to investing in a 401k. (If you are self employed you have other options that aren’t included here but will be covered in a future post).

Tax-Deferred: Traditional IRA

A traditional IRA is a tax-deferred individual retirement account. These accounts fall under IRS rules for IRAs, meaning you can contribute up to $5,000 per year (or $6,000 if you are over age 50) toward your retirement. You get a tax deduction today, and pay income tax when you hit retirement and start pulling funds out. Your ability to contribute is determined by whether or not your income goes over specific IRS benchmarks. You won’t be able to set aside as much money for retirement as you would in a 401k, but you gain the freedom of being able to choose exactly what investments you want to use.

- Upside: tax-deferred like a 401k, ability to choose investments

- Downside: can’t contribute as much as 401k, may be limited if your income is very high

Tax-Free at Retirement: Roth IRA

Like a Traditional IRA, a Roth IRA is an account you can open at the brokerage or investment house of your choosing. You get to select the investments you want, and your ability to invest is limited by how high your income is. However, Roth IRAs are after-tax investments. You won’t get a tax break today like you do with a Traditional IRA or 401k. If you think you are going to be in a higher tax bracket in retirement then it makes sense to pay tax today. Once you pay tax on the funds used to invest in a Roth IRA, you never pay income tax on then again. Another big perk: you can withdraw your contributions (not your investment earnings) at any time without tax or penalty.

- Upside: tax-free retirement, can withdraw contributions at any time, ability to choose investments

- Downside: no tax break, can’t contribute as much as a 401k, may be limited if your income is very high

Tax-Free at Retirement: Roth 401k

Maybe you like your employer’s 401k plan, but you would rather pay tax today to avoid paying higher taxes during retirement. Many employers are now offering a Roth 401k option. It’s got the same high contribution limit of a regular 401k with the tax status of a Roth IRA. You pay tax today on the funds that are invested, and never again. You will have to stick with the 401k’s investment options — so you lose freedom there — but you won’t have to go through the steps of opening up an account elsewhere. Just simply change where the contributions go to with your Human Resources department.

- Upside: high contribution limit, tax-free retirement

- Downside: no tax break, must choose from plan’s investment options

Taxable Investment Accounts

A last option is to go to a brokerage firm and open up a normal investment account. You will pay taxes on the money today and in retirement as well. There’s no “retirement status” associated with the money, so you can add to it and withdraw whenever you want. You will also pay each time you trade an investment. (This could be seen as an upside or downside depending on what you think of the cost structures of other investment options.)

- Upside: ability to choose investments

- Downside: no tax break, no retirement “status”, funds can be withdrawn at any time

Retirement Plan Factors

Before abandoning your work 401k, consider these factors:

- Matching contributions: Before you abandon your 401k (or Roth 401k) consider if you get a match on your investment contribution at work. Even the poorest of investment options are worth sticking with up to the employer match, because a match is like a 100% return on your investment.

- Income taxes: Decide where you stand on taxes. Do you want a tax break today? Then a 401k or Traditional IRA is the best option for you. If you’re not concerned with that then a Roth IRA or Roth 401k is an option.

- Investment costs: A big factor is knowing how much your investments are costing you. It is much easier to see the total cost of your investments when you control the account as you do with a Traditional or Roth IRA. Employer-sponsored 401k plans have hidden administrative fees that are hard to track.

How to Set Investing Goals

As you prepare to invest your money as a way to build wealth, it is important to set investing goals. Having a plan for your money is vital if you want to eventually live the life you want. Obviously, everyone’s investing goals will be different, so you will need to take the time to think about what you want to accomplish with your money. Here are some steps to take as you set investing goals:

1. List What You Want to Accomplish

The first thing you need to do is think about what you will need your money for in the future. Consider the costs of things such as marriage, children, buying a home, paying for college, starting a business, healthcare, travel, and retirement. Some of these things are expenses that you’ll probably need to save for over a long period of time so starting early is helpful.

Think about where you will be at different stages of life, and figure out what you will need your money for at those milestones. This part of the process requires you to think long and hard about how you see your life unfolding over the coming decades. The hopes and dreams you have for yourself and your family will have an impact on how much money you need to accumulate.

For example, money you’ll need for a retirement traveling the world is different from what you would need if you decided to move to South America and spend your days swinging lazily from a hammock. Perhaps you will want to work part time in the early years of your retirement, which will not only keep you active but can help stretch your fixed income.

Or another example would be if you plan to pay for all your child’s college education. You’ll need to plan differently than if you tell your child that you will pay for tuition at the local state school, and he or she will have to make up the difference if a distant school is chosen.

2. Assign Timeframes to Different Milestones

If you know that you’ll be getting married in the next two years, you’ll invest differently than you would for a retirement that is 30 years away. You can use online calculators to help you figure out how much money to set aside to reach certain goals within certain timeframes. If you decide that you can retire comfortably on $800,000, and you plan to retire in 25 years, an online calculator can help you see that you will need to set aside $1,000 a month, assuming a 7% annual return on your money.

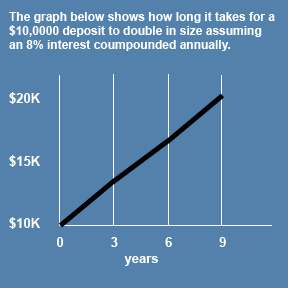

You can use the Rule of 72 to help you estimate what you need to save for other milestones. The Rule of 72 is a formula that lets you approximate how your investments will grow in a retirement or other investment account. Basically, the rule calculates how long it takes to double your money at any given rate of return.

For example, if you contribute a deposit into an investment account, and you anticipate a rate of return of 8%, simply divide 72 by the rate of return and you will have the number of years it will take to double your money. This rule assumes that interest is compounded annually.

72 ÷ 8 = 9

You can also use the rule of 72 to also determine the rate of return needed to double your money over a specific period of time. For example, if you have $10,000 that you want to double for college tuition in 10 years, dividing 72 by 10 will give you the rate of return you’ll need annually compounded to reach that $20,000 goal.

72 ÷ 10 = 7.2%

3. Think About Your Risk Tolerance

As you set investment goals, it’s important to consider your risk tolerance. You will need to choose investments that are likely to help you reach your goal, while at the same time not putting your finances too much at risk. Diversifying your investments can help you get a mix of growth investments and less risky investments that can provide a safety net if you experience a set back. Note that some investments are ideal for short-term goals, and others work better for long-term investing.

4. Be Ready to Adjust Your Portfolio

As you set your investment goals, you need to plan to adjust your portfolio. As we’ve seen over the last decade the market doesn’t always perform as we expect it so some of your assumptions about investment growth may not materialize. If your money isn’t growing as fast as you’ve planned but you still have the same goals with the same costs then you’ll have to increase the amount you’re puttting away to stay on track. The market could make up for poor performance in years down the road but it’s not a sure bet -you know increasing the amount you save will make a difference.

You also have to be ready to adjust your asset allocation as you move through life and get closer to some of your goals. The closer you are to needing the money, the less risk you want to expose it to. Keep track of where you are on your goal timeline, and be prepared to shift from growth investments to investments more likely to protect your capital.

Reaching Your Investment Goals

Setting your goals is an important step, it lets you know what you’re aiming for. However, if you’ve ever made a New Year’s resolution you’re probably aware that achieving a goal can be a lot more difficult that creating it.

Once you have set your goals established, you’ll want to a plan in place to reach them. You’ll know how much money you want to invest each month and chances are you don’t just have that much sitting around in your bank account.

So the first step to reaching your investing goals is to figure out where that money will come from each month. You can find the money by cutting expenses, earning more income, or a combination of the two. Consider what items you can cut from your budget to help you meet your investing goals, it might be easier to make the cuts since you know you’ll be getting something in return down the road for each cut you make now.

Once you know how much spending you can eliminate each month, if you’re still short of your investment goal you can look for ways to earn extra income. You may find your level of motivation to earn more money might be boosted by your investing bucket list. Once you have your investing plan in place and know how you’ll make it happen, it’ll be up to discipline and consistency to accomplish your investing goals.

Investment Asset Allocation 101

Asset allocation is an important concept to understand in investing. However, like so many things related to money, determining your own asset allocation is a personal exercise, and one that doesn’t mean the same thing for every person. Figuring out your own asset allocation means considering your investing goals, and your risk tolerance, in an effort to decide what mix of assets is likely to benefit you the most.

Considerations When Allocating Assets

As you allocate your investment assets, you need to consider diversification. Diversification can help you take advantage of different aspects of some investments, while providing you a degree of protection from risk. The point of asset allocation is to diversify your portfolio in such a way that allows you to enjoy appropriate growth while at the same time reducing — to some degree — your exposure to losses. Here are some things to take into account as you diversify:

Market Cap: Capitalization is a way to measure the size of a company you’re evaluating. The market capitalization of a publicly traded company is determined by the of value of the share price times the number of outstanding shares. Large cap companies usually have values of more than $8 billion. Mid cap companies have a capitalization of between $1 and $8 billion. Small cap stocks are those with a value of less than $1 billion. There are also micro caps with even tinier values.

In general, large cap investments are considered more stable, while smaller cap stocks exhibit the potential for larger growth. You can allocate your assets to include a mix of large and small caps, or use mid caps for a mix of stability and some growth possibility.

Growth: Different investments come with different growth possibilities. The term “value stock” indicates companies whose share price is low compared to it’s balance sheet value, profits, or cash flow. When you buy a value stock you’re betting that based on the fundamentals the price should go up. You may not see an enormous amount of fast growth but the idea is that over time the value of these investments should increase.

Companies that are in markets or industries with alot of opportunity for relatively quick growth or expansion are known as growth stocks. While these can gain in value more quickly they are also more prone to sudden losses. Including growth investments makes your portfolio more volatile but can also give it a boost.

Capital preservation investments, such as bonds and some cash products are designed to help you keep pace with inflation. These are generally considered less risky. Your portfolio won’t grow enough if all you have are capital preservation investments. However, they add a safety net to the portfolio.

Sector and Industry: Consider what kind of investment you are making in terms of industry. If the tech sector is struggling, health products might be doing well. Mixing it up so that you aren’t over-exposed in one sector or industry can help you limit losses if one section of your portfolio tanks.

Asset class: Consider asset class as well. This is paying attention to such things as commodities, real estate, stocks, bonds, cash and currencies. While some asset classes might not be attractive to you, having some diversity across asset classes — even if it is just a stock, bond, cash mix — can be helpful.

Domestic vs Foreign: You can also use asset allocation to diversify into international investments. Some foreign investments, such as bonds in emerging market countries, can add growth to your portfolio. In some cases, there are foreign companies with just as much staying power as venerable U.S. companies; these can add stability to your portfolio.

Deciding on Your Own Asset Allocation

Once you have an idea of the possibilities, it’s time to decide on your own asset allocation. Your asset allocation will change over time, depending on your goals, and your financial risk tolerance.

In the case of retirement, experts recommend that you invest in riskier assets when you are young, since you will see faster growth, and still have time to overcome mistakes. As you get closer to retirement, though, your asset allocation should shift so that your investments are less risky. Many people shift to cash, bonds and low yield dividend paying stocks as they age, since these are investments that provide income, and are considered stable. You might retain some riskier investments in your portfolio, but they would not be the bulk.

There are rules about subtracting your age from 100 or from 120 and using that as a guide for how much you should have in stocks. (I’m 31, so following the 100 rule I should have 69% of my portfolio in stocks.) But, really, it depends on what you’re comfortable with, and how much of hit your finances can take. When in doubt, you can consider the following approximate ideas for asset allocation, depending on when you think you’ll need your money:

Next Year: Cash. Money should be in something safe and fairly accessible. You should have some in other investments, but money you plan on using within the next year should be in cash.

2-7 Years: Income producing assets considered relatively safe, such as high yield CDs and bonds. If your needs are on the far end, mixing in some dividend aristocrats might be worth it.

More than 7 Years: Money you won’t need for at least 7 years is likely to do OK in riskier investments, including stocks. Sometimes, the long term can be a good place for investments that are likely to grow over time, such as real estate.

Before you invest in anything, though, it’s a good idea to do your research, and possibly speak with a professional. All investment comes with the risk of loss, so you should be prepared for that possibility and only put money at risk that you can afford to lose.

IRA Investment Allocations

After comparing a traditional IRA and a Roth IRA and looking at investment risks I thought it would be interesting to talk about a study that looks at investment allocations inside individual retirement accounts.

The Employee Benefit Research Institute has been studying the investment choices of over 11 million IRA investors and recently released some interesting findings about how people are using the accounts and investing their money.

Types of IRAs

In the comparison of the traditional IRA and Roth IRA I pointed out the benefits of both because the best IRA choice for you really depends on your personal situation. Based on the survey, more people are still opting for the traditional IRA – 67% of the investors had their money in a regular IRA. Part of the reason is that almost half of those people brought their money into the account from a tax-qualified plan using a rollover IRA. You may fit into this category, if you left a job and wanted to take your 401k along – you had the option of rolling your money into one of these IRAs.

If you’ve chosen the Roth IRA option, you’re definitely not alone. It was the second most popular type, with just over 23% of the investors in the study going the Roth route. The remainder of the people had their money in either a SEP (Simplified Employer Pension) or SIMPLE (Savings Incentive Match Plan for Employees) IRA.

If you do have a Roth I’d guess that as an investment you see it as more a place to invest for growth rather than capital preservation, am I right? The study found that of the people using a Roth, a majority of them were more likely to have their money in equity mutual funds or stocks rather than bonds, money markets, or balanced funds. Let’s look some more at how people are investing their money in their IRA.

IRA Investor Allocations

I imagine you’re familiar with the concept of asset allocation, if not we’ll be covering it in the next week or so. Basically, it’s the approach of putting your money into various types of investments so that if one asset type does poorly all your money won’t be hit by its performance.

The study broke down the type of assets that people hold in their IRAs:

- 38.5% Equities (equity mutual funds, directly held individual stocks)

- 22.3% Money (money market mutual funds, money market savings accounts, & CDs)

- 13.6% Bonds (bond mutual funds, directly held bonds)

- 12.1% Balanced Funds (balanced, lifestyle/lifecycle, target-date funds)

- 13.6 Other Assets (stable value funds, real estate, fixed & variable annuities, etc)

If you have an IRA how does this breakdown compare to your investments? Not to say that you should use these allocations, it’s just interesting to see how you compare with lost of other investors.

IRA Risk & Age

As you get closer to depending on your investments for income during retirement, it makes sense to adjust your asset allocation to focus more on protecting your money and less on growing it. That’s a common piece of financial advice and it seems many people are taking it into account. According to the study, investors who are over 45 are more likely to have their money in bonds and the “other assets” category.

In contrast, if you have a long time frame until you need the money in your retirement account then it’s smart to focus on growing those funds. If you won’t retire for 30 years and put your money into a money market fund then inflation over the coming decades will really eat into the purchasing power of your retirement money. Based on the study, younger investors have listened to this piece of advice. People under 45 are much more likely to have equities and balanced funds in their IRA than those over 45.

However, there are some younger investors who perhaps aren’t comfortable putting their money at higher risk by investing for growth. About 20% of those under 35 have the majority of their investments in the money asset.

IRA Balances & Risk

It may be that the more you have to lose, the more fearful you are of losing it. The IRA study found that the higher the balance of an account, the lower the percentage of higher risk equities it held. For example, IRA accounts that had balances about 10 times larger had almost 13% less of their money invested in equities.

The accounts with the most money invested (over $250K) were the most diversified and had the highest percentage of cash in bonds, money, and “other assets” categories. They also noticed a difference between rollover IRAs and Roth IRAs. A traditional IRA that had been rolled over from a retirement savings plan typically represented money that a person had been saving for a longer period of time. Since the rollover IRA is usually a much bigger piece of a person’s retirement plan than a Roth, the study found the assets in a rollover IRA to be allocated in a more risk averse manner.

IRA Allocations

As I mentioned earlier, the point isn’t to suggest that your IRA investments should match those found in the EBRI study. What I really wanted to do is to get you thinking about how your money is allocated in your IRA based on what stage you are in life. Or if you don’t have an IRA, these are a few things to consider when you open one someday and are setting up your investment choices.

IRA vs Roth IRA

Traditional IRA or a Roth IRA, which should you open? This is a common question that comes up with many people looking to open an individual retirement account (IRA). I’ll try to make this as concise as possible, and let you decide for yourself which IRA is best for you.

Traditional IRA

Definition: A traditional IRA is a tax-deferred retirement fund, and the contributions may be tax deductible depending on your income and tax filing status. The contributions are made on a pre-tax basis.

Income Restrictions: There are no income restrictions for the traditional IRA. Everyone can contribute to a traditional IRA, but not everyone can deduct the contributions on their taxes based on your level of income.

Withdrawals and Distributions: Withdrawals can be made starting at age 59 1/2, but they cannot be made before that without incurring a penalty. Distributions are required to be made at 70 1/2 years old. This is the FAQ from the IRS about required minimum distributions.

Advantages: The advantages all depend on how much you plan on being worth when you are in your retirement years. If you think that you will have more taxable income during your working years or you make too much money to qualify for a Roth IRA, then a traditional IRA is the right choice for you. The biggest advantage is that you can reduce your taxable income during your working years.

Disadvantages: If you are a great saver, and your IRA distributions end up becoming higher than the income in your working years, then you could end up spending more in taxes during retirement than the money you saved in taxes from your contributions.

Roth IRA

Definition: A Roth IRA is a tax-exempt retirement fund, and contributions are made with after-tax income. Contributions are not tax deductible, but the distributions in retirement are tax free.

Income Restrictions: Single tax filers cannot earn a gross income of more than $100,000 and married tax filers cannot earn more than $169,000 in order to contribute the maximum amount. Married couples making $169,000 and $179,000 can contribute a reduced amount to a Roth and an income over $179,000 means they cannot put any money into a Roth. The range where you can contribute a portion of the maximum to your Roth is called the phase out limit and for a single person it’s $107,000 to $122,000. A single person making over $122,000 can’t put any money into a Roth.

Withdrawals and Minimum Distributions: Like the traditional IRA, the minimum age to start withdrawing funds is 59 and a 1/2 years old. The principal amount can be withdrawn at any time, if you take out earnings early you will incur a steep penalty. The Roth has no minimum distribution requirements.

Advantages: The biggest advantage is not worrying about taxes during retirement. You pay income tax on the money when you earn it but don’t owe any taxes when you take distributions. If your money has been in a Roth for decades it’s hopefully been growing as the value of your investments increase. When you sell those investments you won’t have to pay taxes on your distributions so you aren’t taxed on that growth. If you will earn more in retirement distributions than you do during your working years, then the Roth IRA is for you. Also, not being required to make minimum withdrawals is a very nice thing.

Disadvantage: Contributions are not tax deferred so you don’t lower your income taxes for the year you make the contribution. Not everyone qualifies for the Roth IRA, so high-income earners don’t have the option of opening one.

Traditional IRA or Roth IRA? Not only should you calculate how much income you think you’ll have in retirement vs today, you also have to consider how tax laws will change over time. It’s hard to know what the tax code will look like decades from now when it’s time for you to retire. There’s been a lot of talk about tax reform lately but no one really knows when or if it will happen.

Some people think that taxes will inevitably be higher across the board in the future to help fund social programs like Social Security, Medicaid, and Medicare. Others believe that the US government will keep tax rates relatively low and won’t adopt the high tax rates that many European countries use.

Opening an IRA

Whichever you decide, be sure to talk with your financial advisor about the advantages and disadvantages before you open an account.

Below are a few good places to open an IRA: